Emergence of 5G Technology

The rollout of 5G technology in Brazil is set to revolutionize the telecommunications landscape, presenting new opportunities for the virtual customer-premises-equipment market. With its promise of ultra-fast data speeds and low latency, 5G is expected to enhance the performance of various applications, including IoT and smart city initiatives. This technological advancement is likely to drive demand for virtual customer-premises-equipment solutions that can efficiently manage and optimize network resources. Industry analysts predict that the adoption of 5G will lead to a 30% increase in data traffic by 2027, thereby necessitating the deployment of advanced virtualized solutions. The virtual customer-premises-equipment market industry stands to benefit significantly from this transition, as businesses seek to leverage 5G capabilities for competitive advantage.

Rising Adoption of Remote Work Solutions

The shift towards remote work in Brazil has catalyzed the adoption of advanced networking solutions, significantly influencing the virtual customer-premises-equipment market. As organizations adapt to hybrid work models, the need for reliable and secure connectivity has become increasingly critical. This trend is prompting businesses to invest in virtual customer-premises-equipment solutions that can support remote operations effectively. Data suggests that approximately 60% of companies in Brazil are now utilizing some form of remote work technology, which is likely to continue driving demand for virtualized networking solutions. The virtual customer-premises-equipment market industry is thus poised to capitalize on this trend, providing essential tools for organizations to maintain productivity and collaboration in a distributed work environment.

Growing Demand for Flexible Networking Solutions

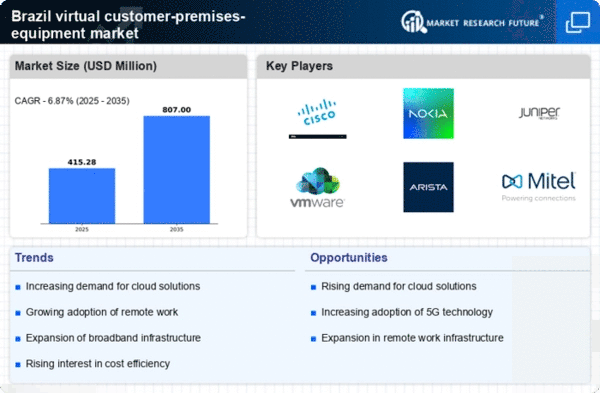

The virtual customer-premises-equipment market in Brazil is experiencing a notable surge in demand for flexible networking solutions. As businesses increasingly seek to adapt to changing market conditions, the need for scalable and agile network infrastructure becomes paramount. This trend is reflected in the growing adoption of virtualized network functions, which allow organizations to deploy services rapidly without the constraints of traditional hardware. According to recent data, the market is projected to grow at a CAGR of approximately 15% over the next five years, driven by the desire for cost-effective and efficient networking solutions. The virtual customer-premises-equipment market industry is thus positioned to benefit from this shift towards flexibility, enabling companies to enhance their operational efficiency and responsiveness.

Focus on Cost Reduction and Operational Efficiency

In Brazil, organizations are increasingly prioritizing cost reduction and operational efficiency, which is influencing their investment decisions in the virtual customer-premises-equipment market. Companies are recognizing the financial benefits of transitioning from traditional hardware to virtualized solutions, which can lower capital expenditures and operational costs. This shift is particularly relevant in a competitive economic environment where businesses are striving to optimize their resources. Recent studies indicate that organizations can achieve up to 40% savings in operational costs by adopting virtual customer-premises-equipment solutions. Consequently, the virtual customer-premises-equipment market industry is likely to see sustained growth as more companies seek to enhance their efficiency while minimizing expenses.

Increased Investment in Telecommunications Infrastructure

Brazil's telecommunications sector is witnessing a significant increase in investment, which is positively impacting the virtual customer-premises-equipment market. The government and private entities are channeling funds into expanding and modernizing network infrastructure, aiming to improve connectivity across urban and rural areas. This investment is crucial for supporting the growing demand for high-speed internet and advanced communication services. Recent reports indicate that investments in telecommunications infrastructure are expected to reach $10 billion by 2026, fostering a conducive environment for the virtual customer-premises-equipment market industry. Enhanced infrastructure not only facilitates better service delivery but also encourages the adoption of innovative technologies, further driving market growth.