Increasing Cyber Threats

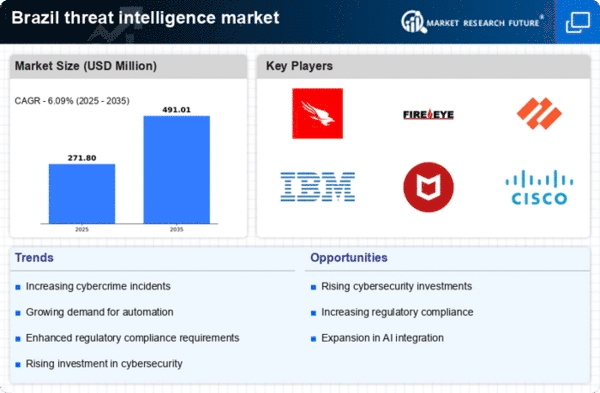

The escalating frequency and sophistication of cyber threats in Brazil is a primary driver for the threat intelligence market. Organizations are increasingly targeted by cybercriminals, leading to a heightened demand for advanced threat intelligence solutions. In 2025, it is estimated that cybercrime could cost the Brazilian economy over $20 billion annually, prompting businesses to invest in threat intelligence to mitigate risks. The threat intelligence market is responding to this urgency by offering solutions that provide real-time insights into emerging threats, enabling organizations to proactively defend against potential attacks. This trend is likely to continue as the digital landscape evolves, necessitating continuous adaptation and enhancement of threat intelligence capabilities.

Adoption of Cloud Technologies

The rapid adoption of cloud technologies in Brazil is significantly influencing the threat intelligence market. As businesses migrate to cloud-based solutions, they encounter new security challenges that necessitate robust threat intelligence capabilities. In 2025, it is projected that over 70% of Brazilian enterprises will utilize cloud services, creating a substantial market for threat intelligence solutions tailored to cloud environments. The threat intelligence market is evolving to address these challenges by offering specialized services that enhance visibility and security in cloud infrastructures. This shift towards cloud adoption is likely to drive innovation and growth within the threat intelligence market.

Emergence of Advanced Technologies

The emergence of advanced technologies, such as artificial intelligence and machine learning, is reshaping the threat intelligence market in Brazil. These technologies enable organizations to analyze vast amounts of data and identify patterns indicative of potential threats. As businesses increasingly leverage these innovations, the demand for sophisticated threat intelligence solutions is expected to rise. In 2025, it is projected that the integration of AI in threat intelligence could enhance detection rates by up to 30%, making it a critical component for organizations aiming to stay ahead of cyber threats. The threat intelligence market is adapting to this technological shift, offering solutions that harness the power of AI and machine learning to provide more effective threat detection and response capabilities.

Regulatory Compliance Requirements

Brazil's regulatory landscape is becoming increasingly stringent, particularly concerning data protection and cybersecurity. The implementation of laws such as the General Data Protection Law (LGPD) has created a pressing need for organizations to comply with legal requirements regarding data security. This regulatory environment drives the demand for threat intelligence market solutions that assist companies in identifying vulnerabilities and ensuring compliance. As organizations face potential fines of up to 2% of their revenue for non-compliance, the threat intelligence market is positioned to provide essential tools and services that help businesses navigate these complex regulations. The focus on compliance is expected to bolster the growth of the threat intelligence market in Brazil.

Growing Investment in Cybersecurity

Investment in cybersecurity is witnessing a notable increase among Brazilian organizations, driven by the need to protect sensitive data and maintain operational integrity. In 2025, it is anticipated that Brazilian companies will allocate approximately $10 billion to cybersecurity initiatives, with a significant portion directed towards threat intelligence solutions. This trend reflects a broader recognition of the importance of proactive threat management in safeguarding assets. The threat intelligence market is poised to benefit from this surge in investment, as organizations seek comprehensive solutions that provide actionable insights and enhance their overall security posture. The increasing budget allocations for cybersecurity are likely to sustain growth in the threat intelligence market.