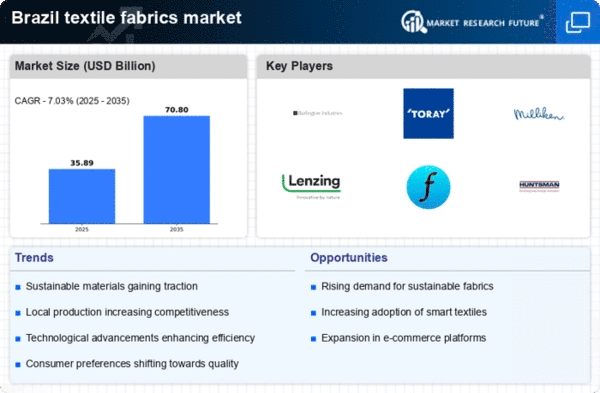

The textile fabrics market in Brazil is characterized by a dynamic competitive landscape, driven by innovation, sustainability, and regional expansion. Key players such as Burlington Industries (US), Toray Industries (JP), and Lenzing AG (AT) are actively shaping the market through strategic initiatives. Burlington Industries (US) focuses on enhancing its product portfolio with sustainable materials, while Toray Industries (JP) emphasizes technological advancements in fabric production. Lenzing AG (AT) is leveraging its expertise in fiber production to cater to the growing demand for eco-friendly textiles. Collectively, these strategies foster a competitive environment that prioritizes sustainability and innovation, positioning these companies as leaders in the market.In terms of business tactics, companies are increasingly localizing manufacturing to reduce lead times and optimize supply chains. The market structure appears moderately fragmented, with several key players exerting influence over various segments. This fragmentation allows for niche players to thrive, while larger companies leverage their scale to implement cost-effective strategies. The collective influence of these key players shapes the market dynamics, as they compete not only on price but also on quality and sustainability.

In October Milliken & Company (US) announced a partnership with a Brazilian textile manufacturer to develop advanced performance fabrics tailored for local industries. This collaboration is strategically significant as it allows Milliken to tap into the regional market while enhancing its product offerings with localized innovations. Such partnerships are likely to strengthen Milliken's position in Brazil, enabling it to respond more effectively to local consumer preferences.

In September Invista (US) launched a new line of sustainable nylon fabrics, which are produced using a patented process that reduces water consumption by 30%. This initiative not only aligns with global sustainability trends but also positions Invista as a forward-thinking player in the textile fabrics market. The introduction of these fabrics could potentially attract environmentally conscious consumers and brands, thereby enhancing Invista's market share.

In August Ahlstrom-Munksjö (FI) expanded its production capabilities in Brazil by investing €10 million in a new facility dedicated to producing specialty nonwovens. This strategic move indicates Ahlstrom-Munksjö's commitment to meeting the increasing demand for innovative textile solutions in the region. The expansion is expected to bolster the company's competitive edge by providing localized production and reducing lead times for customers.

As of November the competitive trends in the textile fabrics market are increasingly defined by digitalization, sustainability, and the integration of AI technologies. Strategic alliances among companies are shaping the landscape, fostering innovation and enhancing supply chain efficiencies. The shift from price-based competition to a focus on technological advancements and sustainable practices is evident. Companies that prioritize these elements are likely to differentiate themselves in a crowded market, ensuring long-term success.