Rising Customer Expectations

The service lifecycle-management market in Brazil was also driven by rising customer expectations. As consumers become more discerning, they demand higher levels of service quality and responsiveness. This shift compels organizations to adopt comprehensive service lifecycle-management strategies that prioritize customer satisfaction. Companies are investing in tools and processes that allow for personalized service experiences, which are essential in meeting these evolving expectations. The market is projected to expand as businesses strive to enhance their service offerings, with a focus on customer-centric approaches that align with the demands of the modern consumer.

Regulatory Compliance and Standards

In Brazil, the service lifecycle-management market is significantly influenced by the need for regulatory compliance and adherence to industry standards. Organizations are compelled to implement robust service management frameworks to meet legal and regulatory requirements. This necessity not only mitigates risks but also enhances operational transparency. The Brazilian government introduced various regulations aimed at improving service quality across sectors, which in turn drove the adoption of lifecycle management solutions. As companies navigate these regulatory landscapes, the demand for comprehensive service lifecycle-management tools is expected to rise, fostering growth in the market.

Increased Focus on Cost Optimization

Cost optimization remains a critical driver in the service lifecycle-management market in Brazil. Organizations are under constant pressure to reduce operational costs while maintaining service quality. This led to a heightened interest in lifecycle management solutions that facilitated efficient resource allocation and process improvements. By adopting these solutions, companies can identify inefficiencies and implement strategies to streamline operations. Market analysis indicates that businesses that effectively leverage service lifecycle-management tools can achieve cost reductions of up to 20%, making this a compelling driver for growth in the market.

Technological Advancements in Service Delivery

Technological advancements play a pivotal role in shaping the service lifecycle-management market in Brazil. The integration of cutting-edge technologies such as cloud computing, IoT, and data analytics transformed how services were delivered and managed. These innovations enable organizations to gain real-time insights into service performance, facilitating proactive decision-making. As businesses increasingly leverage technology to enhance service efficiency, the market is likely to witness substantial growth. Recent estimates suggest that the adoption of advanced technologies could lead to a 15% increase in service delivery efficiency, underscoring the importance of technology in the service lifecycle-management market.

Growing Demand for Efficient Service Management

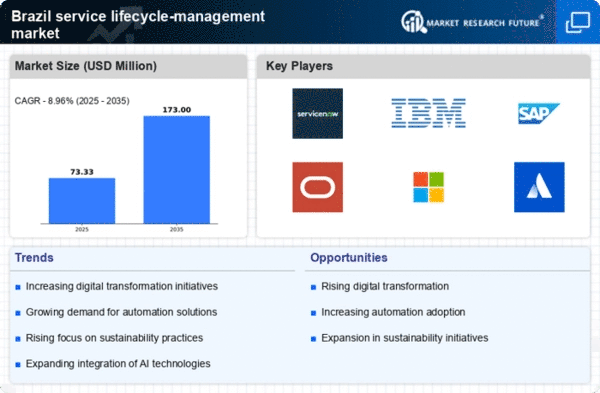

The service lifecycle-management market in Brazil experienced a notable surge in demand for efficient service management solutions. Companies are increasingly recognizing the need to streamline their service processes to enhance customer satisfaction and operational efficiency. This trend was driven by the competitive landscape, where businesses strove to differentiate themselves through superior service delivery. According to recent data, the market is projected to grow at a CAGR of 12% over the next five years, indicating a robust appetite for innovative service management solutions. As organizations seek to optimize their service lifecycles, investments in technology and process improvements are likely to escalate, further propelling the service lifecycle-management market.