Rising Energy Demand

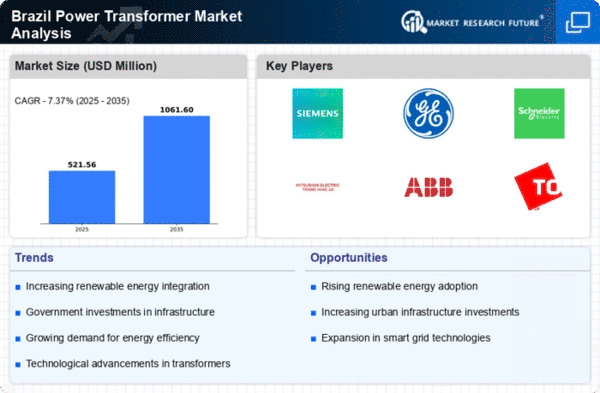

The increasing energy demand in Brazil is a primary driver for the power transformer market. As the population grows and urbanization accelerates, the need for reliable electricity supply intensifies. The Brazilian government has projected a growth in electricity consumption of approximately 4.5% annually over the next decade. This surge necessitates the expansion and modernization of the electrical grid, which directly influences the demand for power transformers. Furthermore, the integration of renewable energy sources, such as wind and solar, into the grid requires advanced transformer technology to manage variable loads effectively. Consequently, the power transformer market is poised for growth as utilities and private investors seek to enhance grid reliability and capacity.

Investment in Renewable Energy

The Brazilian government's commitment to expanding its renewable energy portfolio significantly impacts the power transformer market. With ambitious targets for increasing the share of renewables in the energy mix, investments in wind, solar, and hydroelectric projects are on the rise. The Brazilian Energy Plan aims for renewables to account for over 45% of the total energy matrix by 2030. This transition necessitates the deployment of advanced power transformers capable of handling the unique characteristics of renewable energy sources. Consequently, the power transformer market is expected to benefit from this shift, as manufacturers develop specialized transformers to support the integration of renewables into the grid.

Regulatory Framework Enhancements

Brazil's regulatory environment plays a crucial role in shaping the power transformer market. Recent reforms aimed at improving energy efficiency and reducing emissions have led to stricter standards for electrical equipment, including transformers. The National Electric Energy Agency (ANEEL) has implemented regulations that encourage the adoption of high-efficiency transformers, which are essential for reducing energy losses in transmission and distribution. These regulations not only promote sustainability but also stimulate investments in modern transformer technologies. As a result, the power transformer market is likely to experience increased demand for compliant products, driving innovation and competition among manufacturers.

Urbanization and Infrastructure Development

Brazil's rapid urbanization is a significant driver for the power transformer market. As cities expand, the demand for robust electrical infrastructure becomes increasingly critical. The government has initiated several infrastructure projects aimed at modernizing the electrical grid to accommodate growing urban populations. These projects often involve the installation of new substations and transformers to enhance grid reliability and capacity. According to estimates, urban areas in Brazil are expected to grow by 2.5% annually, further straining existing infrastructure. This trend suggests that the power transformer market will see heightened demand for innovative solutions that can support urban energy needs.

Technological Innovations in Transformer Design

Technological advancements in transformer design are reshaping the power transformer market. Innovations such as smart transformers, which incorporate digital monitoring and control capabilities, are gaining traction in Brazil. These devices enhance operational efficiency and reliability, allowing utilities to respond swiftly to grid fluctuations. Additionally, advancements in materials and manufacturing processes are leading to lighter, more efficient transformers that reduce installation costs and energy losses. As Brazilian utilities seek to modernize their infrastructure, the power transformer market is likely to witness increased adoption of these cutting-edge technologies, driving growth and competitiveness among manufacturers.