Rising Urbanization

Rapid urbanization in Brazil is a crucial driver of the passenger information system market. As cities expand, the demand for efficient public transportation systems increases. Urban areas are projected to house over 85% of Brazil's population by 2030, necessitating advanced information systems to manage transit effectively. These systems enhance communication between transport operators and passengers, providing real-time updates and improving overall service reliability. The Brazilian government has recognized this trend, investing in smart city initiatives that integrate technology into public transport. This investment is likely to boost the passenger information-system market, as municipalities seek to modernize their infrastructure to accommodate growing urban populations.

Technological Advancements

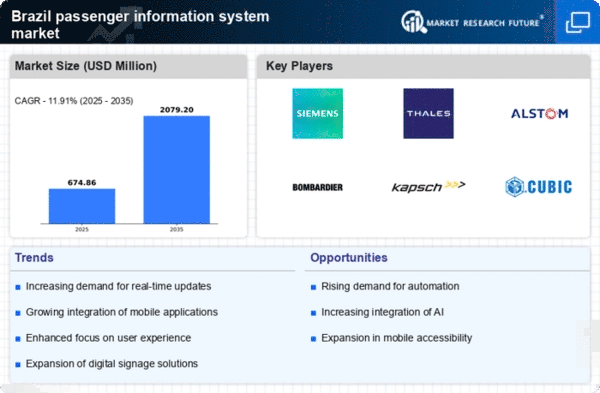

Technological advancements play a pivotal role in shaping the passenger information-system market. Innovations such as mobile applications, GPS tracking, and IoT devices are transforming how passengers interact with public transport. In Brazil, the adoption of these technologies is increasing, with a reported growth of 25% in mobile app usage for transit information in the last year. This trend indicates a shift towards more user-friendly and accessible information systems. Furthermore, Integrating AI and machine learning into these systems enables predictive analytics, enhancing operational efficiency. As technology continues to evolve, the passenger information-system market is expected to expand significantly, driven by the need for smarter, more responsive transport solutions.

Government Funding and Support

Government funding and support are vital for the growth of the passenger information-system market. In Brazil, various federal and state initiatives aim to enhance public transportation infrastructure. Recent allocations of over $1 billion for transport modernization projects indicate a strong commitment to improving transit systems. This funding is often directed towards the development and implementation of advanced passenger information systems, which are essential for efficient transport management. Additionally, public-private partnerships are becoming increasingly common, allowing for shared investment in technology and infrastructure. Such collaborations are likely to accelerate the adoption of innovative solutions within the passenger information-system market, ultimately benefiting commuters across the nation.

Increased Focus on Sustainability

The growing emphasis on sustainability is influencing the passenger information-system market in Brazil. As environmental concerns rise, there is a push for greener public transport solutions. The Brazilian government has set ambitious targets to reduce carbon emissions, which includes promoting the use of public transport over private vehicles. This shift necessitates the implementation of efficient passenger information systems that encourage the use of sustainable transport options. For instance, systems that provide real-time data on bus and train schedules can help optimize routes and reduce wait times, making public transport more appealing. Consequently, the passenger information-system market is likely to see increased investment as stakeholders prioritize eco-friendly initiatives.

Consumer Demand for Real-Time Information

Consumer demand for real-time information is a significant driver of the passenger information-system market. In Brazil, passengers increasingly expect timely updates regarding transit schedules, delays, and service changes. This expectation has led to a surge in the development of systems that provide instant notifications through various channels, including mobile apps and digital signage at stations. Recent surveys indicate that over 70% of commuters prefer using services that offer real-time updates, highlighting the importance of responsive information systems. As public transport operators strive to meet these demands, the passenger information-system market is poised for growth, with a focus on enhancing user experience and satisfaction.