Rising Energy Demand

The increasing energy demand in Brazil is a pivotal driver for the oil gas-pipeline market. As the economy continues to grow, the demand for energy is projected to rise by 4% annually over the next decade. This surge in demand necessitates a robust pipeline network to ensure the efficient transportation of oil and gas to various regions. The government has recognized this need and is prioritizing investments in pipeline infrastructure to meet future energy requirements. Additionally, urbanization and industrial growth are contributing to this rising demand, further emphasizing the importance of a well-developed oil gas-pipeline market. The ability to meet this demand will be crucial for Brazil's energy security and economic stability.

Infrastructure Expansion

The ongoing expansion of pipeline infrastructure in Brazil is a crucial driver for the oil gas-pipeline market. The government has initiated several projects aimed at enhancing the transportation of oil and gas across the country. For instance, the National Agency of Petroleum, Natural Gas and Biofuels (ANP) has reported that investments in pipeline construction are expected to reach approximately $10 billion by 2026. This expansion is essential for meeting the growing domestic demand for energy, which is projected to increase by 3% annually. Furthermore, the development of new pipelines facilitates access to remote oil fields, thereby enhancing production capabilities and ensuring a more reliable supply chain within the oil gas-pipeline market.

Energy Transition Policies

Brazil's commitment to energy transition policies is shaping the oil gas-pipeline market. The government is actively promoting the use of cleaner energy sources while recognizing the continued importance of oil and gas in the energy mix. As part of its energy transition strategy, Brazil aims to reduce greenhouse gas emissions by 37% by 2025. This policy framework encourages investments in pipeline infrastructure that can support both traditional and renewable energy sources. The oil gas-pipeline market is likely to adapt to these changes, with new pipelines being designed to accommodate a diverse range of energy products, thereby enhancing the overall efficiency and sustainability of the energy sector.

Foreign Investment Attraction

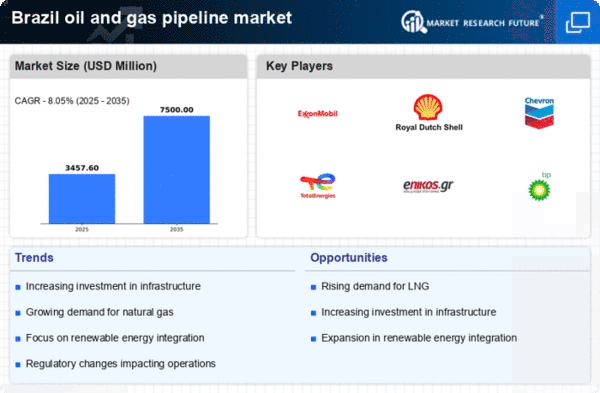

The oil gas-pipeline market in Brazil is witnessing a surge in foreign investments, driven by the country's rich natural resources and favorable investment climate. Recent data indicates that foreign direct investment (FDI) in the oil and gas sector reached $15 billion in 2025, reflecting a growing confidence among international investors. This influx of capital is expected to enhance the development of pipeline infrastructure, as foreign companies seek to capitalize on Brazil's vast reserves. Additionally, partnerships with international firms can lead to the transfer of advanced technologies and best practices, further strengthening the oil gas-pipeline market. As Brazil continues to attract foreign investment, the market is poised for significant expansion.

Increased Domestic Production

Brazil's focus on increasing domestic oil and gas production significantly impacts the oil gas-pipeline market. The country has substantial offshore reserves, particularly in the pre-salt layer, which are becoming increasingly accessible due to advancements in extraction technologies. The Brazilian government aims to boost production to 5 million barrels per day by 2030, which necessitates an extensive network of pipelines to transport this output efficiently. This surge in production not only supports energy security but also positions Brazil as a key player in the regional energy landscape. Consequently, the oil gas-pipeline market is likely to experience robust growth as new pipelines are constructed to accommodate this increased output.