Emergence of 5G Technology

The rollout of 5G technology in Brazil is poised to revolutionize the mobile front-haul market. With its promise of ultra-low latency and high data rates, 5G is expected to drive significant changes in network architecture. Telecom operators are investing heavily in upgrading their infrastructure to support 5G capabilities, which includes enhancing mobile front-haul solutions. According to industry estimates, the 5G market in Brazil could reach $10 billion by 2026, creating a substantial opportunity for mobile front-haul providers. As operators transition to 5G, the demand for efficient and scalable front-haul solutions will likely increase, propelling market growth.

Rising Adoption of IoT Devices

The proliferation of Internet of Things (IoT) devices in Brazil is influencing the mobile front-haul market. As more devices connect to mobile networks, the demand for reliable and high-capacity front-haul solutions intensifies. IoT applications, ranging from smart cities to industrial automation, require seamless connectivity and low latency, which mobile front-haul technologies can provide. It is estimated that the number of IoT devices in Brazil will exceed 1 billion by 2025, further stressing the need for enhanced mobile infrastructure. This trend suggests that the mobile front-haul market will benefit from the increasing integration of IoT solutions, as operators seek to accommodate the growing number of connected devices.

Increasing Demand for High-Speed Connectivity

The mobile front-haul market in Brazil is experiencing a surge in demand for high-speed connectivity, driven by the growing reliance on mobile data services. As consumers increasingly engage in data-intensive activities such as streaming and online gaming, the need for robust mobile infrastructure becomes paramount. Reports indicate that mobile data traffic in Brazil is projected to grow at a CAGR of 30% through 2025, necessitating significant upgrades to existing networks. This trend compels telecom operators to invest in advanced mobile front-haul solutions to enhance bandwidth and reduce latency. Consequently, the mobile front-haul market is likely to expand as service providers seek to meet consumer expectations for seamless connectivity.

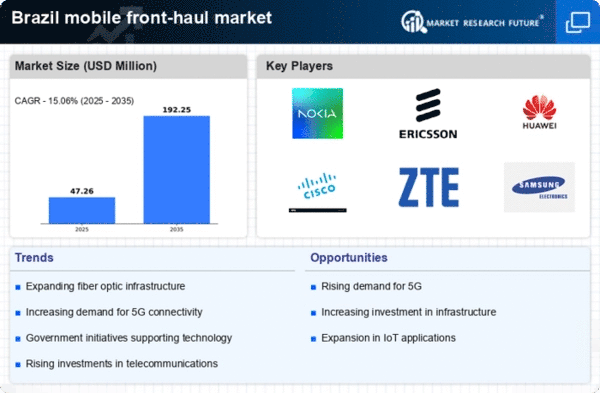

Competitive Landscape and Market Consolidation

The competitive landscape of the mobile front-haul market in Brazil is evolving, with several key players vying for market share. Mergers and acquisitions among telecom operators and technology providers are becoming more common, as companies seek to enhance their capabilities and expand their service offerings. This consolidation is likely to lead to increased investment in mobile front-haul technologies, as firms aim to differentiate themselves in a crowded market. Additionally, the entry of new players with innovative solutions may further stimulate competition, driving advancements in mobile front-haul infrastructure. As the market matures, the dynamics of competition will play a crucial role in shaping the future of the mobile front-haul market.

Government Initiatives for Telecommunications Expansion

Brazil's government has initiated various programs aimed at expanding telecommunications infrastructure, which directly impacts the mobile front-haul market. These initiatives include public-private partnerships and funding for rural connectivity projects, aimed at bridging the digital divide. The National Telecommunications Agency (ANATEL) has set ambitious targets to increase broadband access, with a goal of achieving 90% coverage by 2025. Such regulatory support is expected to stimulate investments in mobile front-haul technologies, as operators will need to enhance their networks to comply with new standards and reach underserved areas. This proactive approach by the government is likely to foster growth in the mobile front-haul market.