Rising Mobile Device Penetration

The mobile cloud market in Brazil is experiencing a notable surge due to the increasing penetration of mobile devices. As of 2025, approximately 80% of the Brazilian population owns a smartphone, which facilitates access to cloud services. This trend indicates a growing reliance on mobile applications that leverage cloud computing for enhanced functionality. The proliferation of affordable smartphones and improved internet connectivity has further accelerated this growth. Consequently, businesses are increasingly adopting mobile cloud solutions to cater to the demands of a mobile-savvy consumer base. This shift not only enhances user experience but also drives operational efficiency, positioning the mobile cloud market as a pivotal component of Brazil's digital economy.

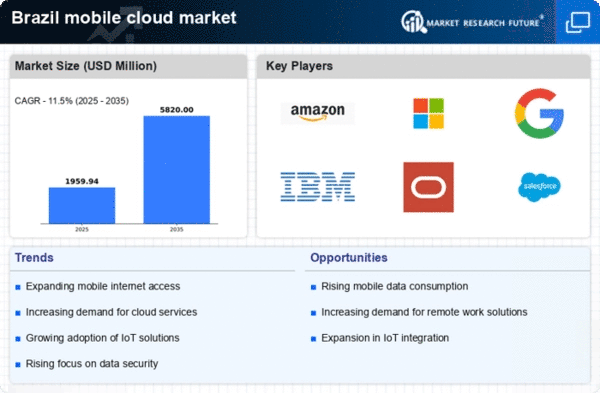

Growing Demand for Remote Work Solutions

The mobile cloud market in Brazil is witnessing a surge in demand for remote work solutions. As organizations increasingly adopt flexible work arrangements, the need for cloud-based collaboration tools has intensified. Reports indicate that 60% of Brazilian companies are now utilizing mobile cloud applications to facilitate remote work. This trend is likely to continue as businesses recognize the benefits of cloud solutions in enhancing productivity and collaboration among distributed teams. The mobile cloud market is thus positioned to thrive, driven by the ongoing shift towards remote work and the necessity for seamless access to data and applications from any location.

Increased Focus on Digital Transformation

the mobile cloud market is driven by a heightened focus on digital transformation across various sectors in Brazil. Companies are increasingly recognizing the need to modernize their IT infrastructure to remain competitive. As of 2025, approximately 70% of Brazilian enterprises are investing in cloud technologies to streamline operations and improve customer engagement. This shift towards digital solutions is likely to drive the adoption of mobile cloud services, as organizations seek to leverage the scalability and flexibility offered by cloud platforms. The mobile cloud market is thus positioned to benefit from this ongoing transformation, as businesses prioritize innovation and efficiency.

Emergence of Innovative Mobile Applications

the mobile cloud market in Brazil is significantly influenced by the emergence of innovative mobile applications. Developers are increasingly creating applications that utilize cloud computing to deliver enhanced functionalities, such as real-time data processing and analytics. This trend is evident in sectors like e-commerce and finance, where mobile apps are integrating cloud services to improve user experience. As of 2025, it is estimated that the number of mobile applications utilizing cloud technology in Brazil has increased by 40%. This growth not only reflects the demand for advanced mobile solutions but also indicates a robust future for the mobile cloud market as businesses continue to innovate.

Government Initiatives Supporting Cloud Adoption

Brazilian government initiatives aimed at promoting digital transformation are significantly impacting the mobile cloud market. Programs designed to enhance internet infrastructure and provide incentives for technology adoption are fostering a conducive environment for cloud services. The government has allocated substantial funding, estimated at $500 million, to improve broadband access in underserved regions. This investment is expected to increase cloud service adoption among small and medium enterprises (SMEs), which represent a large portion of the Brazilian economy. As these businesses leverage mobile cloud solutions, the market is likely to expand, driven by enhanced accessibility and affordability of cloud technologies.