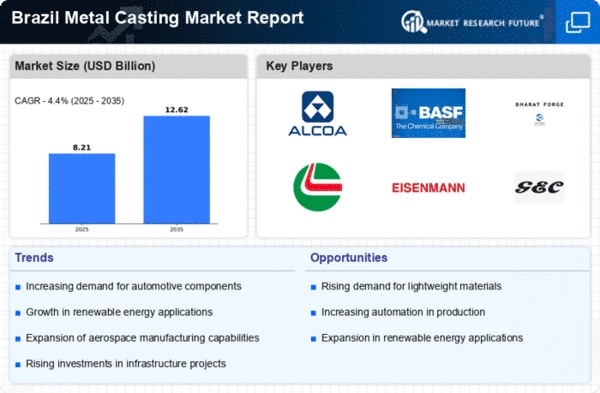

The metal casting market in Brazil exhibits a dynamic competitive landscape, characterized by a blend of established players and emerging innovators. Key growth drivers include the increasing demand for lightweight materials in automotive and aerospace applications, alongside a push for sustainable manufacturing practices. Major companies such as Alcoa Corporation (US), Thyssenkrupp AG (DE), and Bharat Forge Limited (IN) are strategically positioned to leverage these trends. Alcoa Corporation (US) focuses on innovation in aluminum casting technologies, while Thyssenkrupp AG (DE) emphasizes digital transformation and Industry 4.0 initiatives. Bharat Forge Limited (IN) is expanding its footprint through strategic partnerships, enhancing its capabilities in high-performance casting solutions. Collectively, these strategies shape a competitive environment that is increasingly focused on technological advancement and sustainability.Key business tactics within the market include localizing manufacturing to reduce costs and optimize supply chains. The competitive structure appears moderately fragmented, with a mix of large multinational corporations and smaller regional players. This fragmentation allows for diverse offerings and innovation, although the influence of key players remains substantial, as they set benchmarks for quality and efficiency.

In October Alcoa Corporation (US) announced a partnership with a Brazilian technology firm to develop advanced aluminum casting processes aimed at reducing energy consumption by 20%. This strategic move underscores Alcoa's commitment to sustainability and positions it favorably in a market increasingly driven by environmental considerations. The collaboration is expected to enhance Alcoa's operational efficiency while meeting the growing demand for eco-friendly products.

In September Thyssenkrupp AG (DE) launched a new digital platform designed to streamline its metal casting operations in Brazil. This initiative aims to integrate AI and machine learning into production processes, potentially increasing output efficiency by 15%. The platform's introduction reflects Thyssenkrupp's focus on digitalization, which is likely to enhance its competitive edge by optimizing resource allocation and reducing lead times.

In August Bharat Forge Limited (IN) expanded its manufacturing capabilities in Brazil through the acquisition of a local foundry. This strategic acquisition is anticipated to bolster Bharat Forge's production capacity and enable it to cater to the growing demand for high-performance components in the automotive sector. The move illustrates Bharat Forge's aggressive growth strategy and its intent to solidify its market presence in Brazil.

As of November current competitive trends in the metal casting market are increasingly defined by digitalization, sustainability, and the integration of AI technologies. Strategic alliances are becoming pivotal, as companies seek to enhance their technological capabilities and market reach. The competitive differentiation is likely to evolve from traditional price-based competition towards a focus on innovation, technological advancement, and supply chain reliability. This shift suggests that companies prioritizing these aspects will be better positioned to thrive in the evolving landscape.