Rising Demand for Automation

The increasing demand for automation across various sectors in Brazil is a pivotal driver for the IoT integration market. Industries such as manufacturing and logistics are actively seeking to enhance operational efficiency through automated processes. This trend is evidenced by a reported growth of 15% in automation investments in 2025 alone. As companies strive to reduce costs and improve productivity, the integration of IoT technologies becomes essential. The IoT integration market is thus positioned to benefit significantly from this shift, as businesses look to implement smart solutions that facilitate real-time monitoring and control of operations.

Growing Focus on Sustainability

The growing focus on sustainability in Brazil is driving the IoT integration market as organizations seek to implement eco-friendly practices. Companies are increasingly adopting IoT solutions to monitor energy consumption and reduce waste. For example, the integration of IoT technologies in energy management systems has shown to reduce energy costs by up to 20%. This trend reflects a broader commitment to sustainability, which is becoming a key consideration for consumers and businesses alike. The IoT integration market is thus likely to see a surge in demand for solutions that promote environmental responsibility and resource efficiency.

Government Initiatives and Support

Brazilian government initiatives aimed at promoting digital transformation are significantly influencing the IoT integration market. Policies encouraging the adoption of smart technologies in public services and infrastructure are being implemented. For instance, the government has allocated approximately $500 million for technology development in 2025, which includes IoT projects. Such support not only fosters innovation but also creates a conducive environment for the growth of the IoT integration market. The collaboration between public and private sectors is likely to enhance the deployment of IoT solutions across various domains, including transportation and energy.

Increased Investment in Smart Infrastructure

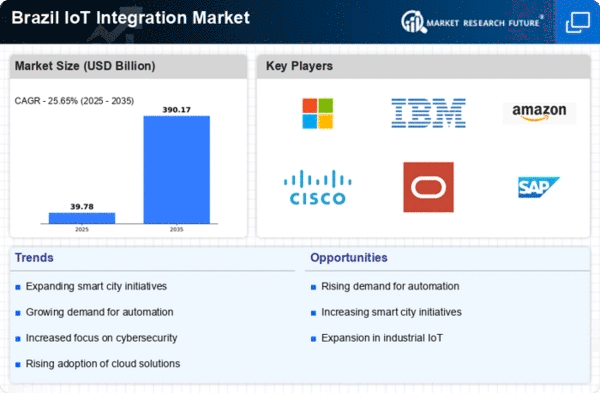

Investment in smart infrastructure is rapidly increasing in Brazil, serving as a significant driver for the IoT integration market. Urban development projects are increasingly incorporating IoT technologies to enhance city management and improve quality of life. In 2025, investments in smart city initiatives are expected to reach $1 billion, focusing on areas such as traffic management and waste disposal. This trend indicates a strong commitment to leveraging technology for urban development. The IoT integration market is poised to benefit from these investments, as cities seek to implement integrated solutions that enhance operational efficiency and citizen engagement.

Expansion of Telecommunications Infrastructure

The expansion of telecommunications infrastructure in Brazil is a crucial driver for the IoT integration market. With the rollout of 5G technology, connectivity is expected to improve significantly, enabling faster and more reliable data transmission. This advancement is projected to increase IoT device adoption by 30% in the next few years. Enhanced connectivity allows for the seamless integration of IoT solutions in various sectors, including smart homes and industrial applications. Consequently, the IoT integration market stands to gain from this infrastructural development, as businesses leverage improved connectivity to implement innovative IoT applications.