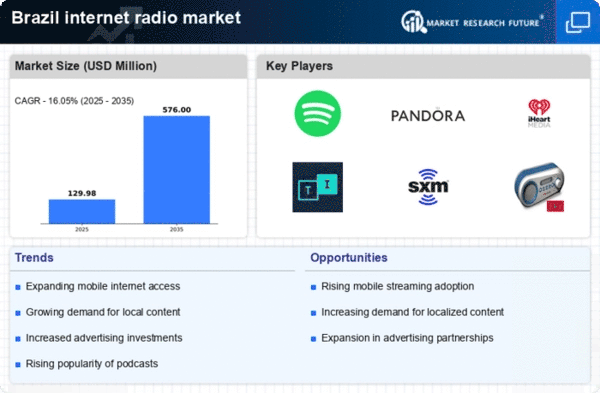

Emergence of Podcasting

The rise of podcasting in Brazil is significantly influencing the internet radio market. As of November 2025, approximately 40% of internet users in Brazil engage with podcasts, which often overlap with traditional internet radio content. This trend indicates a growing appetite for on-demand audio programming, prompting internet radio stations to diversify their offerings by incorporating podcasts into their platforms. The integration of podcasts not only attracts new listeners but also enhances the overall user experience, fostering a more engaged audience. Consequently, the internet radio market is likely to expand as it adapts to this evolving audio landscape.

Diverse Content Offerings

The internet radio market in Brazil benefits from a rich tapestry of content that caters to various demographics and interests. With a multitude of genres ranging from music to talk shows, the availability of localized content resonates with listeners across the nation. This diversity not only attracts a broader audience but also encourages niche stations to flourish. As of 2025, it is estimated that over 1,000 internet radio stations operate in Brazil, providing unique programming that traditional radio may not offer. This variety enhances listener engagement and loyalty, driving advertising opportunities and partnerships within the market.

Technological Advancements

Technological advancements play a crucial role in shaping the internet radio market in Brazil. Innovations in streaming technology, data analytics, and user interface design enhance the listening experience, making it more accessible and enjoyable for users. As of 2025, many internet radio platforms are leveraging artificial intelligence to personalize content recommendations, thereby increasing listener retention. Furthermore, improvements in audio quality and streaming reliability contribute to a more satisfying user experience. These technological developments are expected to drive growth in the internet radio market, as they attract new users and encourage existing listeners to engage more frequently.

Growing Internet Penetration

The expansion of internet access in Brazil is a pivotal driver for the internet radio market. As of 2025, approximately 75% of the Brazilian population has access to the internet, a significant increase from previous years. This growing connectivity facilitates the consumption of digital audio content, allowing users to access a wide array of internet radio stations. The proliferation of affordable smartphones and mobile data plans further enhances this trend, enabling listeners to tune in from virtually anywhere. Consequently, the internet radio market is likely to experience substantial growth as more Brazilians engage with online audio content, leading to increased advertising revenues and subscription models.

Shift in Advertising Strategies

The internet radio market is witnessing a transformation in advertising strategies as brands increasingly recognize the value of digital audio platforms. In Brazil, advertisers are shifting their focus from traditional media to internet radio, which offers targeted advertising capabilities. This shift is evidenced by a reported 30% increase in digital audio advertising spending in 2025 compared to the previous year. Advertisers are drawn to the ability to reach specific demographics and track listener engagement effectively. As a result, the internet radio market is likely to see a surge in revenue from advertising, further solidifying its position in the media landscape.