E-commerce Expansion

The rapid growth of e-commerce in Brazil is significantly influencing the hard disk market. As online retail continues to flourish, businesses require substantial data storage capabilities to handle transactions, customer information, and inventory management. In 2025, e-commerce sales in Brazil are projected to exceed $30 billion, leading to an increased demand for hard disks that can support extensive databases and transaction records. The hard disk market is thus benefiting from this trend, as retailers and logistics companies seek to enhance their IT infrastructure. Additionally, the need for reliable backup solutions is becoming paramount, prompting businesses to invest in high-performance hard disks. This expansion in e-commerce not only drives sales for hard disk manufacturers but also encourages innovation in storage technologies to meet the evolving needs of the retail sector.

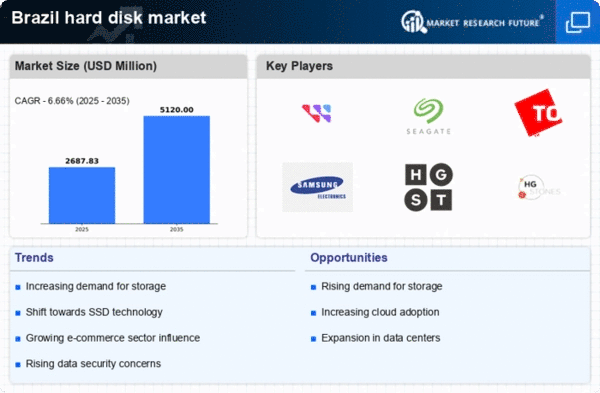

Growing Data Storage Needs

The increasing volume of data generated by businesses and consumers in Brazil is driving the hard disk market. With the rise of digital transformation, organizations are seeking efficient storage solutions to manage vast amounts of information. In 2025, it is estimated that data creation in Brazil will reach approximately 2.5 zettabytes, necessitating robust storage options. This surge in data generation is compelling companies to invest in high-capacity hard disks, which are essential for data centers and cloud storage providers. The hard disk market is thus experiencing a significant uptick in demand as enterprises prioritize data management and storage efficiency. Furthermore, the proliferation of IoT devices and smart technologies is expected to further amplify the need for reliable storage solutions, positioning the hard disk market as a critical component of Brazil's evolving digital landscape.

Increased Focus on Data Security

As cyber threats become more prevalent, the emphasis on data security is influencing the hard disk market in Brazil. Organizations are increasingly prioritizing secure storage solutions to protect sensitive information from breaches and unauthorized access. In 2025, it is estimated that the cybersecurity market in Brazil will reach $10 billion, highlighting the growing awareness of data protection. The hard disk market is responding to this trend by developing drives with enhanced security features, such as encryption and secure access controls. Businesses are likely to invest in these advanced hard disks to safeguard their data assets, thereby driving growth in the market. Furthermore, regulatory compliance requirements are pushing organizations to adopt secure storage practices, further bolstering the demand for hard disks that meet stringent security standards.

Rising Adoption of Cloud Services

The increasing adoption of cloud computing services in Brazil is a pivotal driver for the hard disk market. As businesses migrate to cloud-based solutions, the demand for reliable and scalable storage options is surging. In 2025, the cloud services market in Brazil is projected to grow by over 25%, necessitating robust hard disk solutions to support data storage and management. The hard disk market is thus positioned to capitalize on this trend, as cloud service providers seek to enhance their infrastructure with high-capacity drives. Additionally, the need for data redundancy and backup solutions in cloud environments is prompting investments in hard disk technology. This shift towards cloud services not only drives demand for hard disks but also encourages innovation in storage solutions to meet the evolving requirements of businesses in Brazil.

Technological Advancements in Storage Solutions

Innovations in storage technology are reshaping the hard disk market in Brazil. The introduction of advanced features such as higher data transfer rates, improved durability, and energy efficiency is attracting consumers and businesses alike. In 2025, the hard disk market is expected to witness a shift towards hybrid storage solutions that combine traditional hard disks with solid-state drives (SSDs) for enhanced performance. This trend is likely to cater to the growing demand for faster data access and retrieval, particularly in sectors such as finance and healthcare. Furthermore, the integration of artificial intelligence in storage management systems is anticipated to optimize data organization and retrieval processes. As these technological advancements continue to emerge, they are expected to drive competition among manufacturers, ultimately benefiting consumers through improved product offerings.