Growing Cybersecurity Concerns

In the context of the federal edge-computing market, the rising concerns over cybersecurity are driving the adoption of edge solutions. As government agencies increasingly rely on digital platforms, the risk of cyber threats has escalated. Edge computing offers enhanced security features by processing data closer to its source, thereby reducing the likelihood of data breaches. Brazilian authorities are prioritizing cybersecurity measures, with investments projected to exceed $300 million in the next few years. This focus on security not only protects sensitive information but also instills public confidence in digital government services. Consequently, the federal edge-computing market is likely to see a surge in demand as agencies seek to implement robust security protocols.

Government Initiatives and Funding

Brazil's federal edge-computing market is significantly influenced by government initiatives aimed at modernizing public services. The Brazilian government has allocated substantial funding towards digital transformation projects, which include the adoption of edge computing technologies. These initiatives are designed to enhance the efficiency of public administration and improve citizen engagement. For instance, the government has earmarked over $500 million for technology upgrades in various sectors, which is expected to bolster the federal edge-computing market. Such financial support not only accelerates the deployment of edge solutions but also encourages collaboration among technology providers and government entities, fostering innovation and growth within the market.

Increased Adoption of Smart City Projects

The push for smart city initiatives in Brazil is a critical driver for the federal edge-computing market. As urban areas expand, the need for efficient infrastructure management and enhanced public services becomes paramount. Edge computing technologies facilitate the deployment of smart sensors and IoT devices, enabling real-time data collection and analysis. This integration supports various applications, such as traffic management and waste management systems. According to recent studies, investments in smart city projects are expected to reach $1 billion by 2026, highlighting the potential for edge computing to play a pivotal role in urban development. The federal edge-computing market stands to benefit significantly from these advancements, as they align with the goals of improving urban living conditions.

Rising Demand for Real-Time Data Processing

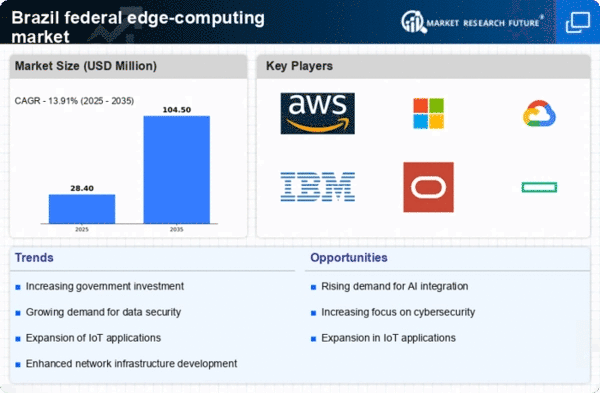

The federal edge-computing market in Brazil is experiencing a notable surge in demand for real-time data processing capabilities. This trend is largely driven by the increasing need for immediate insights in various sectors, including public safety and transportation. As government agencies seek to enhance operational efficiency, the integration of edge computing solutions allows for faster data analysis and decision-making. Reports indicate that the market for edge computing in Brazil is projected to grow at a CAGR of approximately 25% over the next five years. This growth is indicative of the federal edge-computing market's potential to transform how data is utilized across different governmental functions, ultimately leading to improved service delivery and resource management.

Advancements in Telecommunications Infrastructure

The evolution of telecommunications infrastructure in Brazil is a significant catalyst for the federal edge-computing market. The rollout of 5G technology is expected to enhance connectivity and enable faster data transmission, which is crucial for edge computing applications. With improved network capabilities, government agencies can leverage edge solutions to optimize operations and enhance service delivery. The Brazilian telecommunications sector has invested over $10 billion in 5G infrastructure, which is anticipated to be fully operational by 2026. This advancement not only supports the federal edge-computing market but also positions Brazil as a leader in adopting cutting-edge technologies for public service enhancement.