Brazil Expanded Polypropylene Market Summary

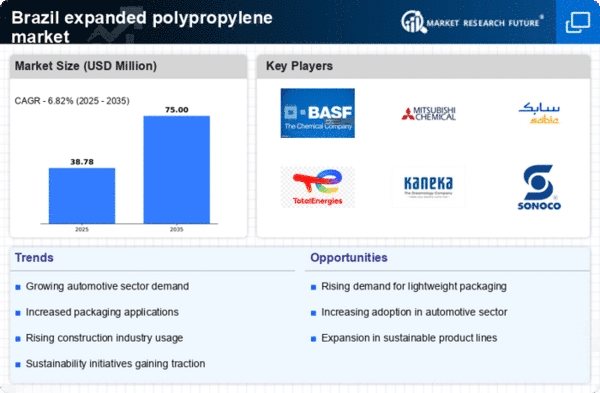

As per Market Research Future analysis, the Brazil expanded polypropylene market size was estimated at 36.3 USD Million in 2024. The Brazil expanded polypropylene market is projected to grow from 38.78 USD Million in 2025 to 75.0 USD Million by 2035, exhibiting a compound annual growth rate (CAGR) of 6.8% during the forecast period 2025 - 2035

Key Market Trends & Highlights

The Brazil expanded polypropylene market is poised for growth driven by sustainability and technological advancements.

- The automotive sector is the largest segment, reflecting robust demand for lightweight materials.

- The packaging sector is the fastest-growing segment, indicating a shift towards sustainable solutions.

- Technological advancements in manufacturing processes are enhancing product performance and reducing costs.

- Rising demand in the packaging sector and regulatory support for recycling initiatives are key market drivers.

Market Size & Forecast

| 2024 Market Size | 36.3 (USD Million) |

| 2035 Market Size | 75.0 (USD Million) |

| CAGR (2025 - 2035) | 6.82% |

Major Players

BASF SE (DE), Mitsubishi Chemical Corporation (JP), SABIC (SA), TotalEnergies SE (FR), Kaneka Corporation (JP), Sonoco Products Company (US), JSP Corporation (JP), Sealed Air Corporation (US)