Focus on Risk Management

In Brazil, the emphasis on risk management is becoming increasingly vital within the enterprise asset-management market. Organizations are recognizing the importance of identifying and mitigating risks associated with asset performance and compliance. This focus is particularly relevant in industries such as manufacturing and energy, where asset failures can lead to significant financial losses. By implementing robust asset-management frameworks, companies can enhance their risk management capabilities, potentially reducing incidents by up to 30%. This proactive approach to risk is a crucial driver for the enterprise asset-management market.

Adoption of Advanced Analytics

The integration of advanced analytics into asset management practices is transforming the enterprise asset-management market in Brazil. Companies are leveraging data analytics to gain insights into asset performance, maintenance needs, and lifecycle management. This analytical approach enables organizations to make informed decisions, thereby reducing downtime and extending asset lifespan. Reports indicate that businesses utilizing predictive analytics can reduce maintenance costs by approximately 15%. As Brazilian enterprises increasingly adopt data-driven strategies, the demand for sophisticated asset-management solutions is likely to grow, further propelling the market.

Investment in Digital Transformation

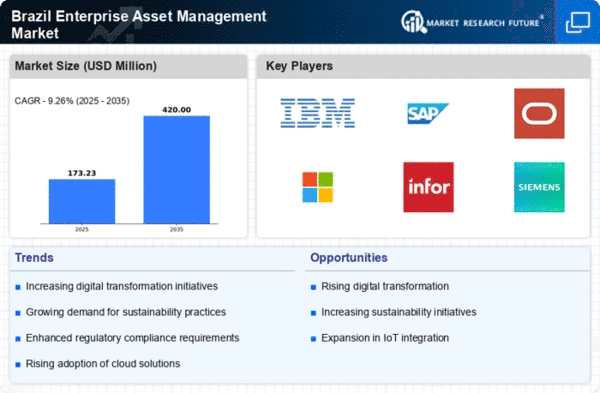

Digital transformation initiatives are significantly influencing the enterprise asset-management market in Brazil. Organizations are investing in digital tools and technologies to streamline asset management processes, enhance visibility, and improve decision-making. The Brazilian government has been promoting digitalization across various sectors, which is expected to drive the adoption of enterprise asset-management solutions. As companies transition to digital platforms, the market is projected to expand, with estimates suggesting a growth rate of around 10% annually. This investment in digital transformation is a key driver for the enterprise asset-management market.

Rising Demand for Operational Efficiency

The enterprise asset-management market in Brazil is experiencing a notable surge in demand for operational efficiency. Organizations are increasingly recognizing the need to optimize asset utilization and reduce operational costs. This trend is driven by the competitive landscape, where companies strive to enhance productivity while minimizing waste. According to recent data, Brazilian firms that implement effective asset-management strategies can achieve cost reductions of up to 20%. This focus on efficiency not only improves profitability but also enhances service delivery, making it a critical driver in the enterprise asset-management market.

Growing Importance of Sustainability Practices

Sustainability practices are gaining traction in the enterprise asset-management market in Brazil. Companies are increasingly aware of the environmental impact of their operations and are seeking ways to integrate sustainable practices into their asset management strategies. This shift is driven by both regulatory pressures and consumer demand for environmentally responsible practices. Brazilian firms that adopt sustainable asset-management solutions can not only improve their corporate image but also achieve cost savings through energy efficiency and waste reduction. The growing importance of sustainability is likely to propel the enterprise asset-management market forward.