Rising Industrial Automation

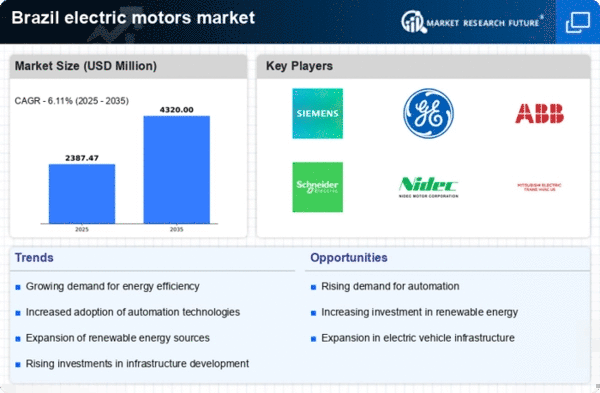

The electric motors market in Brazil is experiencing a notable surge due to the increasing trend of industrial automation. As industries strive for enhanced productivity and efficiency, the demand for electric motors is expected to rise significantly. In 2025, the Brazilian manufacturing sector is projected to invest approximately $5 billion in automation technologies, which will likely drive the need for electric motors. This shift towards automation not only improves operational efficiency but also reduces labor costs, making electric motors a vital component in various applications. The electric motors market is thus poised for growth as more companies adopt automated solutions to remain competitive in a rapidly evolving economic landscape.

Increased Focus on Sustainability

The growing emphasis on sustainability in Brazil is a crucial driver for the electric motors market. As businesses and consumers alike become more environmentally conscious, there is a rising demand for energy-efficient electric motors that minimize carbon footprints. By 2025, it is projected that the market for sustainable electric motors will expand by 15%, reflecting a shift towards greener technologies. This trend is further supported by regulatory frameworks that encourage the adoption of energy-efficient solutions. The electric motors market is likely to see increased investment in sustainable practices, which not only meets consumer demand but also aligns with global sustainability goals.

Growth in Electric Vehicle Infrastructure

The expansion of electric vehicle (EV) infrastructure in Brazil is a significant driver for the electric motors market. With the increasing adoption of EVs, there is a corresponding demand for electric motors that power these vehicles. By 2025, the Brazilian government aims to have over 1 million electric vehicles on the road, necessitating a robust supply chain for electric motors. This growth in the EV sector is expected to create opportunities for manufacturers and suppliers within the electric motors market. The integration of electric motors in EVs not only enhances performance but also aligns with Brazil's environmental goals, further stimulating market growth.

Technological Advancements in Motor Design

Technological advancements in electric motor design are significantly impacting the electric motors market in Brazil. Innovations such as improved efficiency, reduced size, and enhanced performance are making electric motors more appealing to various industries. In 2025, it is estimated that the market for high-efficiency electric motors will grow by 20%, driven by advancements in materials and design techniques. These improvements not only lower operational costs but also contribute to sustainability efforts, making electric motors a preferred choice in many applications. The electric motors market is thus benefiting from ongoing research and development, which is likely to yield even more efficient and versatile motor solutions.

Government Initiatives for Renewable Energy

Brazil's commitment to renewable energy sources is influencing the electric motors market positively. The government has implemented various initiatives aimed at promoting the use of renewable energy, which includes the integration of electric motors in wind and solar energy systems. By 2025, it is anticipated that renewable energy will account for over 50% of Brazil's energy matrix, creating a substantial demand for electric motors. These motors are essential for converting renewable energy into usable power, thereby supporting the electric motors market. The alignment of government policies with sustainable energy goals is likely to foster innovation and investment in electric motor technologies.