Rising Data Consumption

The edge data-center market in Brazil is experiencing a surge in demand driven by the exponential growth in data consumption. With the increasing adoption of IoT devices and mobile applications, data traffic is projected to rise significantly. According to recent estimates, data traffic in Brazil is expected to grow by over 30% annually, necessitating the deployment of edge data centers to process data closer to the source. This trend is particularly relevant in urban areas where connectivity is paramount. As businesses seek to enhance their digital capabilities, the edge data-center market is positioned to benefit from this rising demand, enabling faster data processing and improved user experiences.

Emergence of 5G Technology

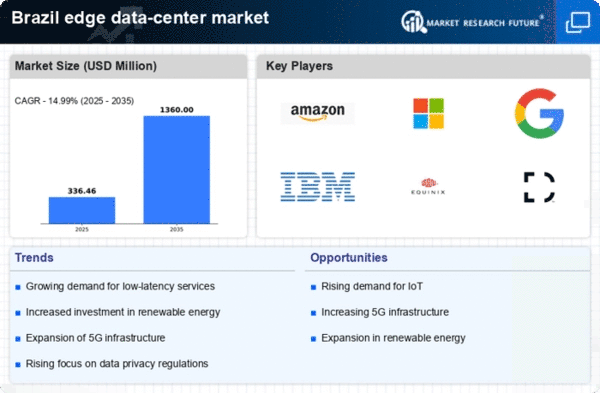

The rollout of 5G technology in Brazil is anticipated to have a profound impact on the edge data-center market. With 5G networks offering significantly higher speeds and lower latency, the need for localized data processing becomes more critical. This technology is expected to enhance applications such as autonomous vehicles, smart cities, and augmented reality, all of which require real-time data processing. As 5G infrastructure expands, the edge data-center market is likely to see increased demand for services that can handle the vast amounts of data generated. Analysts suggest that the integration of 5G with edge computing could lead to a market growth rate of over 25% in the coming years.

Government Initiatives and Support

The Brazilian government is actively promoting digital transformation initiatives, which are likely to bolster the edge data-center market. Policies aimed at enhancing connectivity and infrastructure development are being implemented, with investments exceeding $1 billion in recent years. These initiatives are designed to support the growth of technology sectors, including data centers. Furthermore, the government's focus on improving internet access in rural areas may lead to increased demand for edge data centers, as they can provide localized services. This supportive regulatory environment is expected to create a favorable landscape for the edge data-center market, encouraging investments and innovation.

Focus on Enhanced Security Measures

As cyber threats continue to evolve, the edge data-center market in Brazil is witnessing a heightened focus on security measures. Organizations are increasingly aware of the vulnerabilities associated with centralized data storage and are turning to edge computing as a solution. By processing data closer to the source, businesses can reduce the risk of data breaches and enhance their overall security posture. This trend is particularly relevant in sectors such as finance and healthcare, where data protection is paramount. The edge data-center market is likely to see growth. This growth is due to companies investing in secure, localized data processing solutions to safeguard sensitive information.

Shift Towards Hybrid Cloud Solutions

The trend towards hybrid cloud solutions is influencing the edge data-center market in Brazil. Organizations are increasingly adopting hybrid models to balance their on-premises and cloud resources, which necessitates the deployment of edge data centers for efficient data management. This shift is driven by the need for enhanced security, compliance, and performance. As businesses seek to optimize their IT infrastructure, the edge data-center market is likely to benefit from this transition. Reports indicate that hybrid cloud adoption in Brazil could reach 60% by 2026, further solidifying the role of edge data centers in supporting these strategies.