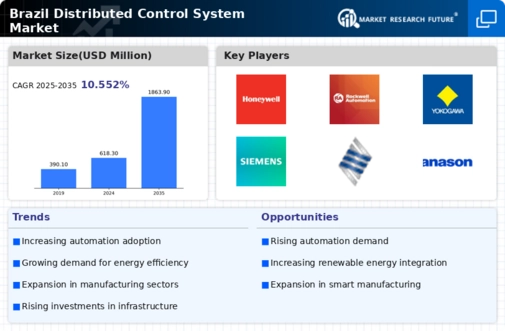

Brazil Distributed Control System Market Summary

The Brazil Distributed Control System Market is projected to experience substantial growth from 618.3 USD Million in 2024 to 1863.9 USD Million by 2035.

Key Market Trends & Highlights

Brazil Distributed Control System Market Key Trends and Highlights

- The market is expected to grow at a compound annual growth rate of 10.55 percent from 2025 to 2035.

- By 2035, the market valuation is anticipated to reach 1863.9 USD Million, indicating robust expansion.

- In 2024, the market is valued at 618.3 USD Million, reflecting a strong foundation for future growth.

- Growing adoption of automation technologies due to increased industrial efficiency is a major market driver.

Market Size & Forecast

| 2024 Market Size | 618.3 (USD Million) |

| 2035 Market Size | 1863.9 (USD Million) |

| CAGR (2025-2035) | 10.55% |

Major Players

Honeywell, Rockwell Automation, Yokogawa Electric, Siemens, Emerson, Panasonic, General Electric, Phoenix Contact, Omron, Endress+Hauser, Beckhoff Automation, Krohne, Mitsubishi Electric, Schneider Electric, ABB