Growing Cloud Adoption

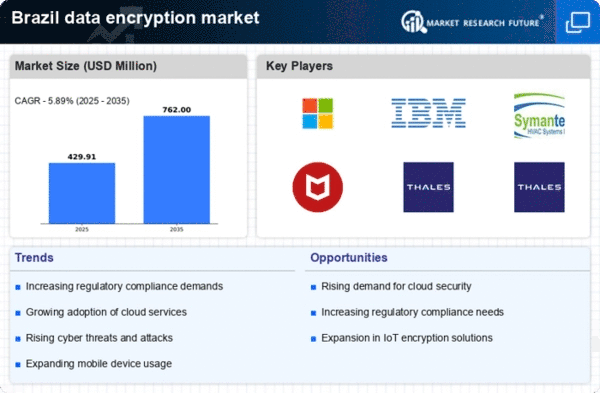

The rapid adoption of cloud computing services in Brazil has created a pressing need for data encryption solutions to protect sensitive information stored in the cloud. As organizations increasingly migrate their operations to cloud platforms, the data encryption market is projected to grow by 20% over the next few years. This growth is driven by the necessity to secure data against unauthorized access and ensure compliance with data protection regulations. The integration of encryption technologies into cloud services not only enhances security but also supports the overall growth of the data encryption market.

Rising Cybersecurity Threats

The increasing frequency and sophistication of cyberattacks in Brazil has heightened the demand for robust data protection solutions. As organizations face threats such as ransomware and data breaches, the data encryption market experiences significant growth. In 2025, it is estimated that cybercrime could cost the Brazilian economy over $20 billion annually, prompting businesses to invest in encryption technologies to safeguard sensitive information. This trend indicates a strong correlation between the rise in cyber threats and the expansion of the data encryption market, as companies prioritize securing their data assets against malicious actors.

Increased Mobile Device Usage

The proliferation of mobile devices in Brazil has led to a surge in data generation and transmission, necessitating enhanced security measures. With over 80% of the population using smartphones, the data encryption market is experiencing a notable uptick in demand for mobile encryption solutions. As users become more aware of the risks associated with mobile data breaches, businesses are compelled to implement encryption technologies to protect sensitive information. This trend suggests that the data encryption market will continue to expand as mobile device usage increases and security concerns grow.

Evolving Data Privacy Regulations

The introduction of stringent data privacy regulations in Brazil, such as the General Data Protection Law (LGPD), has created a pressing need for organizations to adopt data encryption solutions. Compliance with these regulations is essential to avoid hefty fines, which can reach up to 2% of a company's revenue. As businesses strive to meet these legal requirements, the data encryption market is likely to see a surge in demand for encryption tools and services. This regulatory landscape compels organizations to prioritize data security, thereby driving growth in the data encryption market.

Digital Transformation Initiatives

Brazilian enterprises are undergoing extensive digital transformation initiatives, which necessitate the implementation of advanced security measures. As organizations migrate to digital platforms, the data encryption market is poised for growth, with a projected increase of 15% in encryption software adoption by 2026. This shift is driven by the need to protect customer data and comply with evolving data protection regulations. The integration of encryption technologies into digital transformation strategies not only enhances security but also fosters consumer trust, thereby propelling the data encryption market forward in Brazil.