Emergence of 5G Technology

The rollout of 5G technology in Brazil is poised to have a transformative impact on the data center-interconnect market. With its promise of ultra-low latency and high-speed connectivity, 5G is expected to facilitate new applications and services that require rapid data transfer. Analysts predict that the adoption of 5G will drive a 40% increase in data traffic by 2026, necessitating enhanced interconnect solutions to manage this influx. Data centers will need to upgrade their infrastructure to support the demands of 5G, including the deployment of edge computing resources. This evolution presents opportunities for service providers to innovate and offer tailored interconnect solutions that leverage the capabilities of 5G technology, thereby enhancing the overall efficiency of the data center-interconnect market.

Expansion of Cloud Services

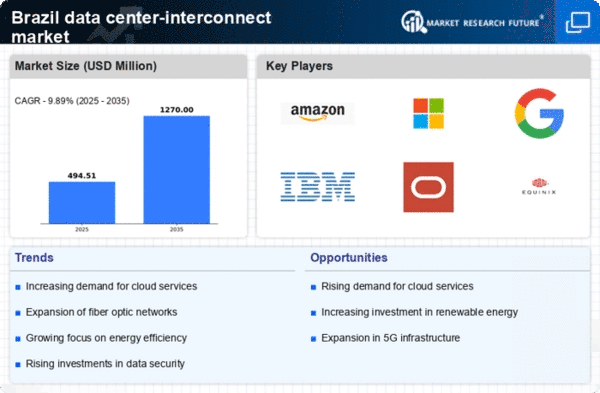

The proliferation of cloud services in Brazil is a significant driver for the data center-interconnect market. As organizations migrate their operations to the cloud, the need for seamless interconnectivity between data centers becomes critical. Reports suggest that the cloud computing market in Brazil is expected to reach $10 billion by 2025, reflecting a compound annual growth rate (CAGR) of 25%. This growth necessitates robust interconnect solutions to facilitate efficient data transfer and storage. Data centers must adapt to this shift by implementing scalable interconnect architectures that can handle increased workloads. Moreover, partnerships between cloud service providers and data center operators are likely to intensify, fostering innovation and enhancing service delivery in the data center-interconnect market.

Increased Focus on Data Security

Data security concerns are becoming increasingly prominent in Brazil, influencing the data center-interconnect market. As cyber threats evolve, organizations are prioritizing secure data transmission and storage solutions. The Brazilian government has implemented stringent regulations to protect sensitive information, which has led to a heightened demand for secure interconnect technologies. It is estimated that investments in cybersecurity measures will grow by 20% annually, as businesses seek to safeguard their data assets. This trend compels data centers to integrate advanced security protocols into their interconnect solutions, ensuring compliance with regulatory standards. Consequently, the data center-interconnect market is likely to witness innovations in encryption and secure access technologies, addressing the growing need for data protection.

Investment in Renewable Energy Sources

The growing emphasis on sustainability is influencing the data center-interconnect market in Brazil, particularly through investments in renewable energy sources. As data centers consume significant amounts of energy, there is a pressing need to adopt greener practices. Reports indicate that the renewable energy market in Brazil is expected to grow by 15% annually, driven by government initiatives and corporate sustainability goals. This shift encourages data centers to explore energy-efficient interconnect solutions that minimize their carbon footprint. By integrating renewable energy sources, data centers can not only reduce operational costs but also enhance their appeal to environmentally conscious clients. Thus, the data center-interconnect market is likely to evolve, focusing on sustainable practices that align with broader environmental objectives.

Rising Demand for High-Speed Connectivity

The data center-interconnect market in Brazil is experiencing a surge in demand for high-speed connectivity solutions. As businesses increasingly rely on cloud services and data-intensive applications, the need for faster and more reliable interconnectivity becomes paramount. Recent studies indicate that the demand for bandwidth in Brazil is projected to grow by approximately 30% annually, driven by the expansion of digital services. This trend compels data centers to enhance their interconnect capabilities, ensuring they can support the growing traffic. Consequently, investments in advanced networking technologies, such as fiber optics and high-capacity routers, are likely to increase, further propelling the data center-interconnect market. The competitive landscape is also evolving, with service providers striving to offer superior connectivity options to meet customer expectations.