Shift Towards 5G Deployment

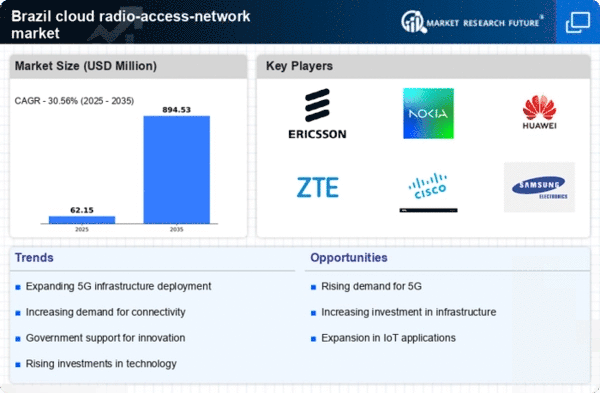

The transition to 5G technology is a significant driver for the cloud radio-access-network market in Brazil. With the rollout of 5G networks, there is an increasing need for advanced radio access solutions that can support higher frequencies and lower latency. The Brazilian telecommunications sector is expected to invest over $10 billion in 5G infrastructure by 2026, indicating a strong commitment to modernizing network capabilities. The cloud radio-access-network market stands to gain from this shift, as it enables operators to deploy 5G services more efficiently and cost-effectively. Additionally, the demand for IoT applications and smart city initiatives is likely to accelerate the adoption of cloud-based solutions, further enhancing the market's growth prospects.

Emergence of New Business Models

The cloud radio-access-network market in Brazil is witnessing the emergence of innovative business models that leverage cloud technologies. Telecommunications companies are increasingly adopting as-a-service models, allowing them to offer flexible and scalable solutions to their customers. This shift is driven by the need for agility and responsiveness in a rapidly changing market landscape. The cloud radio-access-network market is well-positioned to support these new business models, as it enables operators to deploy services without the burden of extensive infrastructure investments. Furthermore, the rise of partnerships and collaborations among technology providers and telecom operators is likely to enhance service offerings, creating a more dynamic and competitive market environment.

Increased Focus on Cost Efficiency

Cost efficiency is becoming a critical factor for telecommunications operators in Brazil, driving the adoption of cloud radio-access-network solutions. As competition intensifies, service providers are seeking ways to reduce operational costs while maintaining service quality. The cloud radio-access-network market offers a compelling value proposition by enabling network virtualization and centralized management, which can lead to significant savings. Reports suggest that operators can reduce their capital expenditures by up to 30% through the implementation of cloud-based architectures. This focus on cost efficiency is likely to encourage more players in the Brazilian market to explore cloud radio-access-network technologies, thereby expanding the overall market landscape.

Rising Demand for High-Speed Connectivity

The cloud radio-access-network market in Brazil is experiencing a surge in demand for high-speed connectivity. As more consumers and businesses rely on digital services, the need for robust and efficient network solutions becomes paramount. This demand is reflected in the increasing number of internet users, which reached approximately 150 million in 2025, representing a growth of around 10% from the previous year. The cloud radio-access-network market is poised to benefit from this trend, as it offers scalable solutions that can accommodate the growing data traffic. Furthermore, the Brazilian government has been promoting initiatives to enhance broadband access, which is likely to further stimulate investment in cloud radio-access-network technologies. This environment creates a favorable landscape for service providers to expand their offerings and improve service quality.

Government Initiatives for Digital Transformation

The Brazilian government is actively promoting digital transformation initiatives, which serve as a catalyst for the cloud radio-access-network market. Programs aimed at enhancing digital infrastructure and connectivity are being prioritized, with investments in broadband expansion and technology adoption. The government has allocated approximately $1.5 billion for digital inclusion projects in 2025, which is expected to bolster the cloud radio-access-network market. These initiatives not only aim to improve access to digital services but also encourage innovation among telecommunications providers. As a result, the market is likely to witness increased collaboration between public and private sectors, fostering an environment conducive to the growth of cloud-based solutions.