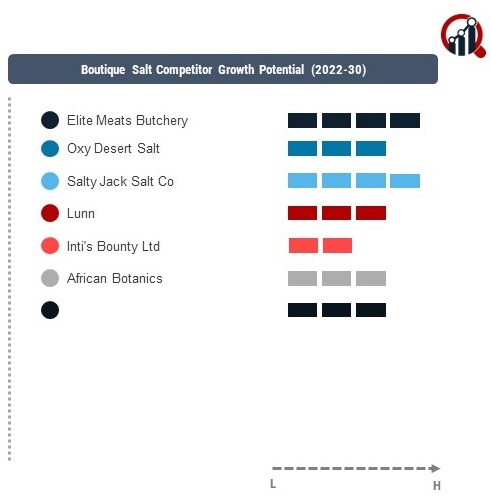

Top Industry Leaders in the Boutique salt Market

The competitive landscape of the boutique salt market is characterized by key players employing diverse strategies to navigate the unique and niche market for premium salt products. As of 2023, major players have established their positions, focusing on product differentiation, sustainability, and strategic partnerships to maintain a competitive edge in this specialized industry.

The competitive landscape of the boutique salt market is characterized by key players employing diverse strategies to navigate the unique and niche market for premium salt products. As of 2023, major players have established their positions, focusing on product differentiation, sustainability, and strategic partnerships to maintain a competitive edge in this specialized industry.

Key Players:

Elite Meats Butchery

Oxy Desert Salt

Salty Jack Salt Co

Lunn

Inti's Bounty Ltd

African Botanics

Strategies Adopted:

Strategies adopted by these key players revolve around product quality, branding, and sustainability. Maldon Crystal Salt Co. and Jacobsen Salt Co. emphasize the artisanal and handcrafted nature of their salts, positioning themselves as premium choices for consumers who seek exceptional culinary experiences. Falksalt differentiates itself through a range of innovative flavors, catering to the evolving tastes of consumers looking for unique seasoning options. Saltverk focuses on sustainability, highlighting its use of renewable geothermal energy in the production of its salt. Amagansett Sea Salt Co. adopts a small-batch approach, emphasizing the purity of its solar-evaporated sea salt.

Market Share Analysis:

The boutique salt market is influenced by factors such as product uniqueness, packaging, distribution channels, and partnerships. Companies that successfully communicate the distinct characteristics of their boutique salts, invest in attractive packaging, and secure partnerships with high-end retailers or gourmet food outlets tend to secure a larger market share. Additionally, effective marketing strategies that convey the story behind the salt, such as its origin and production process, contribute significantly to brand positioning and market share.

News & Emerging Companies:

The boutique salt market have gained attention in 2023, introducing innovations such as exotic salt varieties, limited-edition releases, and collaborations with renowned chefs. These companies contribute to the market's diversification by addressing evolving consumer preferences for exclusive and unique culinary experiences. While their market share may be relatively modest compared to established brands, their agility and ability to experiment with novel salt formulations play a crucial role in shaping the overall market landscape.

Industry Trends:

The growing importance of sustainability and premiumization within the boutique salt market. Companies are investing in eco-friendly packaging, traceability in the supply chain, and ethical sourcing practices. Additionally, there is a trend towards premiumization, with consumers increasingly willing to pay a premium for high-quality, unique, and sustainably produced boutique salts. This shift in consumer preferences has led to increased investments in storytelling, branding, and marketing efforts to create an aspirational and premium image for boutique salt products.

Competitive Scenario:

The boutique salt market reflects a blend of established players with global recognition and emerging disruptors offering innovative solutions. Key players maintain their market leadership through a focus on quality, branding, and strategic investments in sustainability and premiumization. Emerging companies contribute to the market's dynamism with a focus on niche markets, limited-edition releases, and responsiveness to evolving consumer preferences. The competition is further intensified by the entry of startups, technological advancements, and the industry's response to changing culinary trends.

Recent Development

The boutique salt market expanding their product lines to include wellness-oriented salts. Some key players have announced the introduction of boutique salts infused with wellness-promoting ingredients such as herbs, botanicals, and minerals. This development aligns with the industry's recognition of the growing interest in functional foods and wellness-focused culinary choices, providing consumers with unique and health-enhancing gourmet options.