Focus on Patient-Centric Design

The Portable Medical Ventilators Market is increasingly emphasizing patient-centric design principles. Manufacturers are recognizing the importance of creating devices that are not only functional but also user-friendly for both patients and caregivers. This includes features such as lightweight designs, intuitive interfaces, and customizable settings that cater to individual patient needs. The focus on ergonomics and ease of use is likely to enhance patient compliance and satisfaction, which are critical factors in respiratory care. As a result, companies that prioritize these design elements may gain a competitive edge in the market, potentially leading to increased sales and market share.

Regulatory Support and Standards

The Portable Medical Ventilators Market benefits from a supportive regulatory environment that encourages innovation and ensures safety. Regulatory bodies are continuously updating standards to accommodate new technologies and improve patient safety. This proactive approach not only fosters trust among healthcare providers and patients but also stimulates market growth. For instance, recent updates in regulations have streamlined the approval process for new portable ventilators, allowing manufacturers to bring their products to market more efficiently. This regulatory support is crucial in a rapidly evolving industry, as it helps maintain high standards while promoting the introduction of advanced devices.

Increased Demand in Home Care Settings

The Portable Medical Ventilators Market is witnessing a notable increase in demand for home care applications. As healthcare systems shift towards more patient-centered approaches, the need for portable ventilators that can be used in home settings is becoming more pronounced. This trend is driven by an aging population and a rise in chronic respiratory diseases, which necessitate ongoing respiratory support. Market data suggests that the home care segment is expected to account for a significant share of the overall market, with estimates indicating it could reach nearly 40% by 2026. This shift not only alleviates pressure on hospital resources but also provides patients with the comfort of receiving care in familiar surroundings.

Rising Awareness of Respiratory Health

The Portable Medical Ventilators Market is experiencing growth driven by rising awareness of respiratory health issues. Public health campaigns and educational initiatives are increasingly highlighting the importance of respiratory care, leading to greater demand for portable ventilators. As awareness grows, more patients and healthcare providers are recognizing the benefits of using portable devices for managing respiratory conditions. Market analysis indicates that this heightened awareness could lead to a substantial increase in sales, with projections suggesting a potential market expansion of over 15% in the coming years. This trend underscores the critical role that education plays in shaping market dynamics.

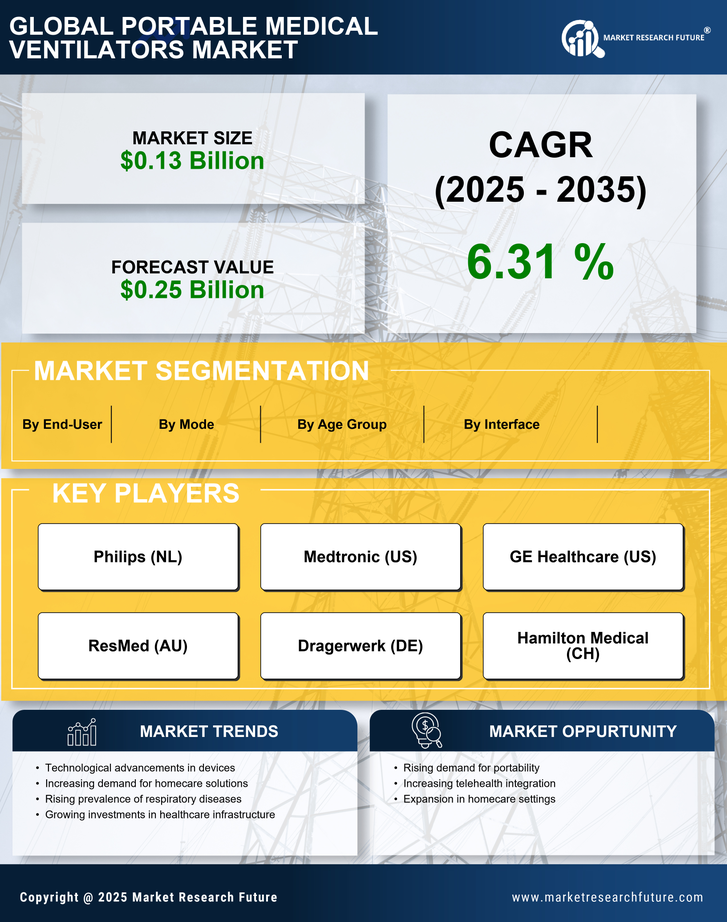

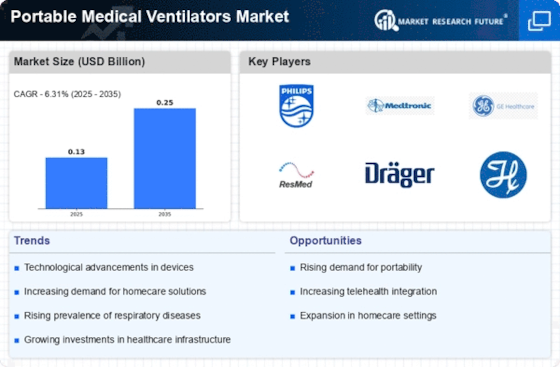

Technological Advancements in Portable Medical Ventilators

The Portable Medical Ventilators Market is experiencing a surge in technological advancements that enhance the functionality and efficiency of these devices. Innovations such as smart ventilators equipped with artificial intelligence and machine learning algorithms are becoming increasingly prevalent. These technologies allow for real-time monitoring and adjustments based on patient needs, potentially improving outcomes. Furthermore, the integration of telemedicine capabilities enables healthcare providers to remotely monitor patients, which is particularly beneficial in emergency situations. According to recent data, the market for advanced portable ventilators is projected to grow at a compound annual growth rate of approximately 8% over the next five years, indicating a robust demand for these innovative solutions.