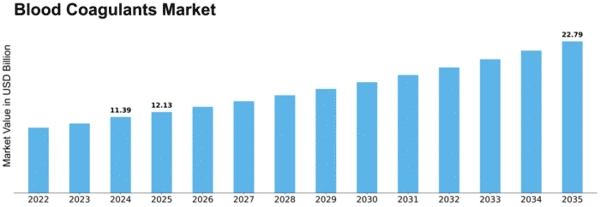

Blood Coagulants Size

Blood Coagulants Market Growth Projections and Opportunities

The market for Blood Coagulants is appreciably influenced by the growing occurrence of hemostatic problems, which include hemophilia and von Willebrand ailment. The increasing occurrence of those conditions globally contributes to the developing demand for powerful blood coagulation treatment options. The demand for Blood Coagulants is driven by the widespread use of those sellers in surgical methods and trauma cases. Blood Coagulants play an essential function in stopping immoderate bleeding for the duration of surgical procedures and handling bleeding associated with annoying injuries, contributing to their large utility in healthcare settings. The worldwide demographic shift in the direction of a growing old population is a key component driving the Blood Coagulants market. Older individuals are extra at risk of hemostatic problems and might require blood coagulation aid, leading to expanded demand for these treatments as the elderly population continues to develop. Cardiovascular diseases frequently require anticoagulant therapy to prevent blood clots and related complications. The growing occurrence of cardiovascular sicknesses globally contributes drastically to the demand for Blood Coagulants, particularly anticoagulant medicines. Blood coagulants are increasingly being explored for new warning signs beyond conventional uses. Research and development efforts are cognizant of expanding the therapeutic packages of Blood Coagulants to cope with a wider variety of situations, similarly using market increase. The evolving healthcare landscape emphasizes patient-centric approaches, influencing the improvement of Blood Coagulants. Therapies that offer stepped-forward comfort, reduced aspect effects, and stronger affected person adherence contribute to the market's evolution, aligning with the wider goals of affected person satisfaction and consequences. Collaborations and partnerships between pharmaceutical businesses, study establishments, and healthcare agencies play a pivotal role in advancing Blood Coagulants. These partnerships foster research, improvement, and the commercialization of revolutionary coagulation treatments, shaping the aggressive panorama. Stringent regulatory requirements and help for the development of safe and effective Blood Coagulants influence market dynamics. Regulatory approvals and compliance with established hints are vital for gaining acceptance as true with healthcare professionals and making sure of the successful introduction of recent coagulation merchandise to the market.

Leave a Comment