Increasing Awareness Among Farmers

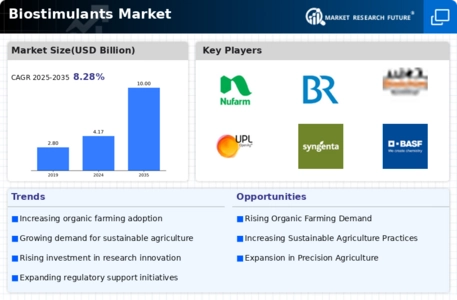

The Global Biostimulants Industry is witnessing heightened awareness among farmers regarding the benefits of biostimulants. Educational initiatives and outreach programs are effectively disseminating information about the advantages of using biostimulants for crop enhancement. Farmers are increasingly recognizing that biostimulants can improve soil health, increase yield, and enhance crop quality. This growing awareness is likely to drive adoption rates, as farmers seek to optimize their agricultural practices. As a result, the industry is expected to see substantial growth, with the market projected to reach 10 USD Billion by 2035, reflecting the shift towards more sustainable farming methods.

Rising Global Population and Food Demand

The Global Biostimulants Industry is significantly influenced by the rising global population and the corresponding increase in food demand. As the world population continues to grow, projected to reach approximately 9.7 billion by 2050, the pressure on agricultural systems intensifies. Biostimulants Market offer a viable solution to enhance crop productivity and ensure food security. By improving plant resilience and nutrient efficiency, biostimulants can help meet the increasing food demands without expanding agricultural land. This urgency for sustainable food production is likely to propel the market forward, contributing to a projected market value of 4.17 USD Billion in 2024.

Regulatory Support and Policy Initiatives

The Global Biostimulants Industry benefits from supportive regulatory frameworks and policy initiatives aimed at promoting sustainable agricultural practices. Governments worldwide are increasingly recognizing the potential of biostimulants to enhance crop productivity while minimizing environmental impact. For instance, various countries have established guidelines for the registration and use of biostimulants, facilitating market entry for innovative products. This regulatory support not only fosters research and development but also encourages investment in the biostimulant sector. As a result, the industry is poised for growth, with projections indicating a market value of 10 USD Billion by 2035, driven by favorable policies.

Growing Demand for Sustainable Agriculture

The Global Biostimulants Industry is experiencing a surge in demand driven by the increasing emphasis on sustainable agricultural practices. Farmers are increasingly seeking alternatives to synthetic fertilizers and pesticides, which have been linked to environmental degradation. Biostimulants Market, derived from natural sources, enhance plant growth and resilience, thereby promoting sustainability. This shift is evidenced by the projected market value of 4.17 USD Billion in 2024, reflecting a growing recognition of the need for eco-friendly agricultural solutions. As consumers become more environmentally conscious, the demand for biostimulants is likely to continue rising, supporting the industry's expansion.

Technological Advancements in Biostimulant Production

Technological advancements play a pivotal role in shaping the Global Biostimulants Industry. Innovations in extraction and formulation techniques have led to the development of more effective and targeted biostimulant products. For example, advancements in microbial technology have enabled the production of biostimulants that enhance nutrient uptake and stress tolerance in plants. These innovations not only improve the efficacy of biostimulants but also expand their application across various crops. As the industry evolves, the integration of cutting-edge technologies is expected to drive market growth, contributing to a compound annual growth rate of 8.28% from 2025 to 2035.