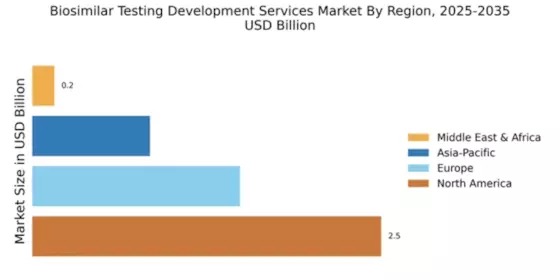

North America : Market Leader in Biosimilars

North America is poised to maintain its leadership in the Biosimilar Testing Development Services Market, holding a market size of $2.52B in 2025. Key growth drivers include a robust regulatory framework, increasing healthcare costs, and a rising demand for affordable biologics. The FDA's supportive policies for biosimilars are expected to further enhance market dynamics, fostering innovation and competition in the sector.

The United States stands as the largest contributor, with significant investments from major players like Amgen, Pfizer, and Mylan. The competitive landscape is characterized by strategic collaborations and mergers, aimed at enhancing service offerings and expanding market reach. The presence of established companies and a growing number of biosimilar approvals are expected to drive market growth in the region.

Europe : Emerging Biosimilar Hub

Europe is emerging as a significant player in the Biosimilar Testing Development Services Market, with a market size of $1.5B in 2025. The region benefits from a favorable regulatory environment, with the European Medicines Agency (EMA) actively promoting biosimilar development. Increasing healthcare expenditure and a shift towards cost-effective treatment options are key drivers of market growth, alongside rising patient awareness regarding biosimilars.

Leading countries such as Germany, France, and the UK are at the forefront of this growth, supported by strong healthcare systems and a high demand for biologics. Major companies like Sandoz and Boehringer Ingelheim are expanding their biosimilar portfolios, enhancing competition. The European market is characterized by a mix of established players and new entrants, fostering innovation and improving access to biosimilars.

Asia-Pacific : Rapidly Growing Market

The Asia-Pacific region is witnessing rapid growth in the Biosimilar Testing Development Services Market, with a projected market size of $0.85B in 2025. Key growth drivers include increasing healthcare investments, a rising prevalence of chronic diseases, and a growing demand for affordable treatment options. Regulatory bodies in countries like India and China are also streamlining approval processes, which is expected to boost market dynamics significantly.

Countries such as India and China are leading the charge, with a burgeoning number of biosimilar approvals and a strong presence of local manufacturers. Companies like Samsung Bioepis and Teva are actively expanding their operations in the region. The competitive landscape is evolving, with both local and international players vying for market share, thereby enhancing the overall growth potential of the biosimilar market in Asia-Pacific.

Middle East and Africa : Emerging Market Opportunities

The Middle East and Africa (MEA) region is gradually emerging in the Biosimilar Testing Development Services Market, with a market size of $0.16B in 2025. The growth is driven by increasing healthcare investments, a rising prevalence of chronic diseases, and a growing demand for affordable biologics. Regulatory bodies are beginning to establish frameworks for biosimilar approvals, which is expected to catalyze market growth in the coming years.

Countries like South Africa and the UAE are leading the way, with initiatives aimed at enhancing healthcare access and affordability. The competitive landscape is still developing, with a mix of local and international players entering the market. As awareness of biosimilars increases, the region is expected to see a rise in biosimilar approvals and market participation, paving the way for future growth.