Advancements in Research and Development

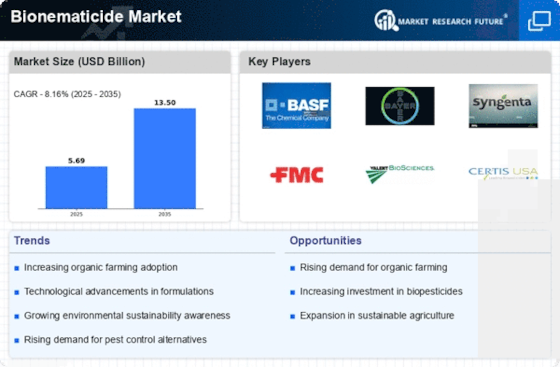

Innovations in research and development are significantly shaping the bionematicide Market. Ongoing studies into the efficacy of various biological agents against nematodes are yielding promising results, which could enhance the performance of bionematicides. The development of new formulations and application techniques is likely to improve the effectiveness and user-friendliness of these products. Furthermore, collaborations between research institutions and agricultural companies are fostering the creation of novel bionematicide solutions. As these advancements continue, the Bionematicide Market is expected to expand, driven by the introduction of more effective and targeted products that meet the evolving needs of farmers.

Rising Incidence of Nematode Infestations

The prevalence of nematode infestations in various crops is a pressing concern for agricultural producers, thereby influencing the Bionematicide Market. Nematodes are known to cause substantial yield losses, prompting farmers to seek effective control measures. The increasing incidence of these pests has led to a surge in demand for bionematicides, which offer a biological alternative to traditional chemical treatments. Market data suggests that the bionematicide segment is expected to witness robust growth, as farmers look for solutions that not only mitigate nematode damage but also align with sustainable farming practices. This trend indicates a promising future for the Bionematicide Market as it addresses the urgent need for effective pest management.

Consumer Preference for Chemical-Free Produce

The Bionematicide Market is witnessing a shift in consumer preferences towards chemical-free produce, which is influencing agricultural practices. As consumers become more health-conscious and environmentally aware, the demand for organic and sustainably produced food is on the rise. This trend is prompting farmers to seek alternatives to synthetic pesticides, leading to an increased interest in bionematicides. Market analysis indicates that the organic food sector is expanding, and with it, the need for effective pest management solutions that align with organic standards. Consequently, the Bionematicide Market is likely to benefit from this consumer-driven demand, as it provides viable options for pest control that meet the expectations of health-conscious consumers.

Government Initiatives Promoting Biopesticides

Government initiatives aimed at promoting biopesticides are playing a pivotal role in the growth of the Bionematicide Market. Various countries are implementing policies that encourage the use of biological pest control methods as part of their agricultural strategies. These initiatives often include financial incentives, research funding, and educational programs designed to inform farmers about the benefits of bionematicides. As regulatory frameworks become more supportive of sustainable practices, the adoption of bionematicides is likely to increase. This trend suggests a favorable environment for the Bionematicide Market, as government backing can significantly enhance market penetration and consumer acceptance.

Increasing Awareness of Sustainable Agriculture

The Bionematicide Market is experiencing a notable shift as awareness of sustainable agricultural practices rises among farmers and consumers alike. This heightened consciousness is driving demand for eco-friendly pest control solutions, including bionematicides. As consumers increasingly prefer products that are free from synthetic chemicals, farmers are compelled to adopt sustainable practices to meet market expectations. Reports indicate that the market for sustainable agriculture is projected to grow significantly, with bionematicides playing a crucial role in this transition. The emphasis on environmental stewardship is likely to propel the Bionematicide Market forward, as more stakeholders recognize the benefits of integrating biological solutions into their pest management strategies.