Increased Investment in Fintech Innovations

Increased investment in fintech innovations is emerging as a significant driver for the Biometric Payment Card Market. Financial institutions and technology companies are allocating substantial resources to develop and implement biometric payment solutions. This influx of investment is fostering a competitive landscape, encouraging the development of cutting-edge biometric technologies. Market data indicates that global fintech investment reached USD 105 billion in 2021, with a notable portion directed towards biometric solutions. Such financial backing is likely to accelerate the introduction of biometric payment cards, making them more accessible to consumers and businesses alike. As the fintech sector continues to evolve, it may further enhance the market for biometric payment solutions.

Rising Consumer Awareness of Security Features

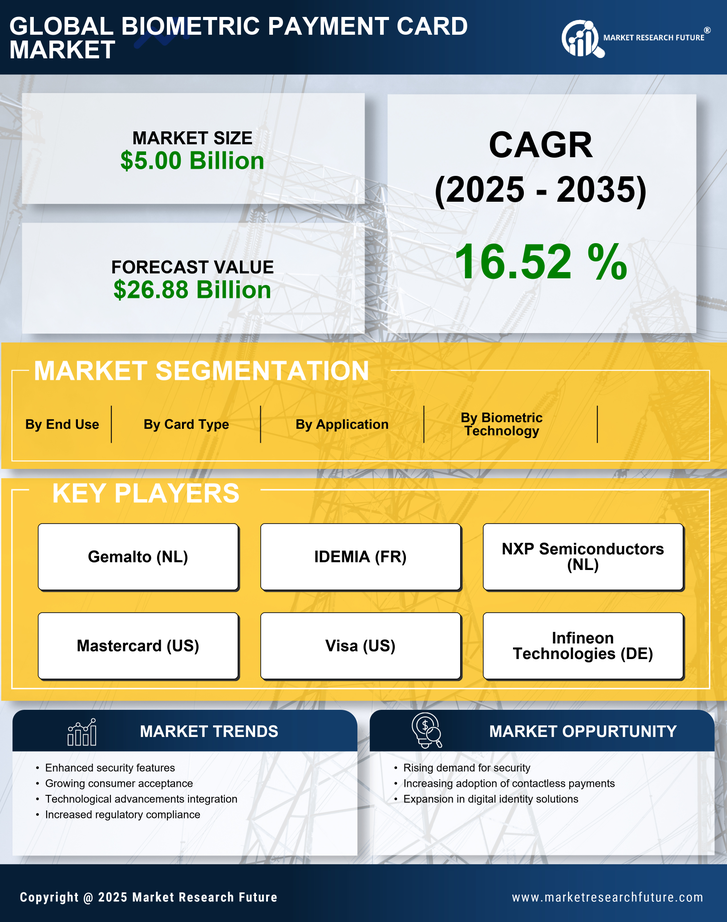

The increasing consumer awareness regarding security features in payment methods appears to be a pivotal driver for the Biometric Payment Card Market. As individuals become more informed about the risks associated with traditional payment methods, they are likely to seek alternatives that offer enhanced security. Biometric payment cards, which utilize fingerprint or facial recognition technology, provide a higher level of security compared to conventional cards. This shift in consumer behavior is reflected in market data, indicating that the biometric payment card segment is projected to grow at a compound annual growth rate of approximately 20% over the next five years. Such growth suggests that consumers are prioritizing security, thereby driving demand for biometric solutions in the payment sector.

Growing E-commerce and Digital Payment Adoption

The surge in e-commerce and digital payment adoption is contributing to the growth of the Biometric Payment Card Market. As more consumers engage in online shopping and digital transactions, the demand for secure payment methods is intensifying. Biometric payment cards offer a seamless and secure way to authenticate transactions, which is particularly appealing in the context of rising online fraud. Market data suggests that e-commerce sales are projected to exceed USD 6 trillion by 2024, indicating a substantial opportunity for biometric payment solutions. This trend suggests that as digital transactions become more prevalent, the need for enhanced security measures, such as biometric authentication, will likely drive the adoption of biometric payment cards.

Technological Advancements in Biometric Systems

Technological advancements in biometric systems are likely to play a crucial role in the expansion of the Biometric Payment Card Market. Innovations in sensor technology, data encryption, and artificial intelligence are enhancing the accuracy and reliability of biometric authentication methods. For instance, the integration of advanced fingerprint sensors and facial recognition algorithms is making biometric payment cards more user-friendly and secure. Market data indicates that The Biometric Payment Card Market is expected to reach USD 50 billion by 2026, which could further stimulate the adoption of biometric payment solutions. As technology continues to evolve, it may lead to more sophisticated biometric payment cards, thereby attracting a broader consumer base.

Regulatory Framework Supporting Biometric Solutions

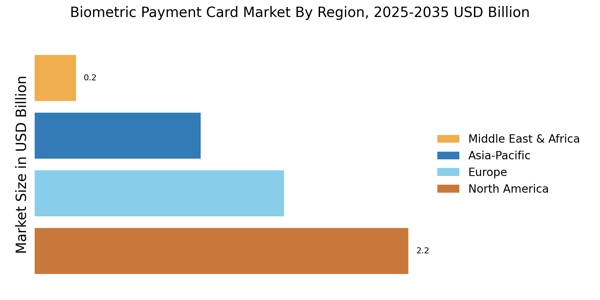

The establishment of a regulatory framework supporting biometric solutions is likely to bolster the Biometric Payment Card Market. Governments and regulatory bodies are increasingly recognizing the importance of secure payment methods and are implementing guidelines that promote the use of biometric technologies. This regulatory support not only enhances consumer confidence but also encourages financial institutions to adopt biometric payment solutions. Market data suggests that regions with supportive regulatory environments are witnessing faster adoption rates of biometric technologies. As regulations evolve to accommodate biometric payment cards, it may lead to increased market penetration and consumer acceptance, thereby driving the overall growth of the industry.