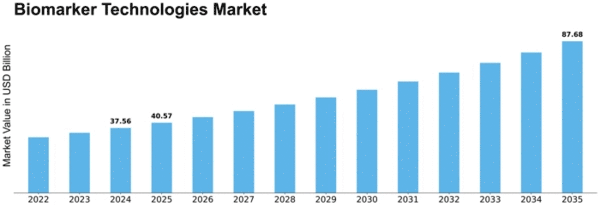

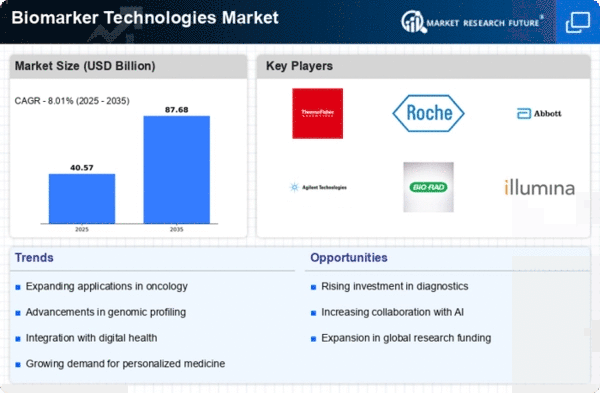

Biomarker Technologies Size

Biomarker Technologies Market Growth Projections and Opportunities

In the realm of healthcare and diagnostics, the Biomarker Technologies market is characterized by a dynamic landscape where companies employ various market share positioning strategies to address the growing demand for advanced biomarker technologies. A pivotal strategy in this field is product differentiation, where companies focus on developing cutting-edge technologies for biomarker identification, detection, and analysis. This may include innovative assays, advanced imaging techniques, or novel platforms for biomarker discovery. By offering unique and sophisticated solutions, companies strive to stand out in a competitive market, positioning themselves as leaders in providing state-of-the-art biomarker technologies for diagnostic and therapeutic applications.

Cost leadership is another significant strategy in the Biomarker Technologies market, acknowledging the importance of affordability in healthcare solutions. Companies aim to optimize the costs associated with biomarker assays, diagnostic tests, and research tools without compromising precision and reliability. This involves streamlining manufacturing processes, negotiating favorable agreements with suppliers, and implementing cost-effective testing protocols. By providing cost-efficient biomarker technologies, companies not only enhance their market share but also contribute to wider accessibility, making these advanced diagnostic tools more available to healthcare professionals and researchers.

Market segmentation is a crucial aspect of strategic positioning within the Biomarker Technologies market. Recognizing the diverse applications and needs across different disease areas, companies tailor their biomarker technologies to address specific conditions or therapeutic areas. This could involve developing specialized assays for cancer biomarkers, neurodegenerative diseases, or cardiovascular disorders. By precisely targeting these niche markets, companies strengthen their overall market presence and ensure that their biomarker technologies are tailored to the specific requirements of various researchers and healthcare professionals.

Strategic collaborations and partnerships play a vital role in the Biomarker Technologies market, reflecting the interdisciplinary nature of biomarker research and application. Companies often engage with academic institutions, pharmaceutical companies, diagnostic laboratories, and healthcare providers to enhance their understanding of biomarkers, access valuable datasets, and accelerate the development of new technologies. Collaborative efforts enable companies to stay at the forefront of biomarker research, positioning themselves as leaders in innovation and reinforcing their market share in the rapidly evolving field.

Customer-centric strategies are paramount in the Biomarker Technologies market, given the impact of biomarkers on patient diagnosis, prognosis, and treatment decisions. Companies that prioritize user-friendly interfaces, accurate and rapid results, and compatibility with existing healthcare systems contribute to increased customer satisfaction and loyalty. Building strong relationships with researchers, clinicians, and diagnostic laboratories through training programs and ongoing support enhances the adoption of biomarker technologies, positively impacting the market share of companies offering these essential diagnostic tools.

Geographic expansion is a crucial component of market share positioning in the Biomarker Technologies market. Companies often target regions with a high prevalence of specific diseases or where there is a growing demand for advanced biomarker technologies. Establishing a robust presence in key markets allows companies to adapt their products and services to regional variations in healthcare practices and preferences, contributing to an increased market share on a global scale.

Leave a Comment