Market Analysis

In-depth Analysis of Biomarker Technologies Market Industry Landscape

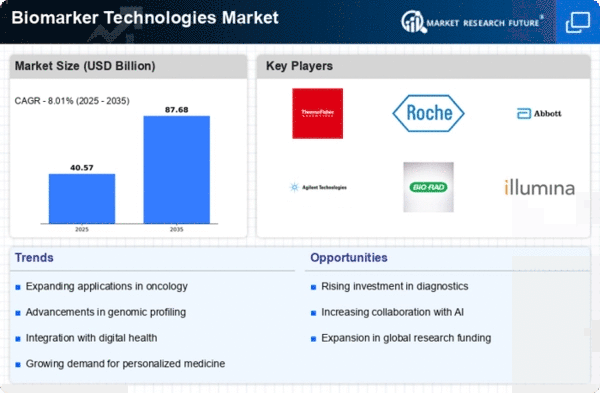

The Biomarker Technologies market is experiencing dynamic trends driven by the expanding applications of biomarkers in medical research, diagnostics, and personalized medicine. One notable trend shaping the market is the increasing adoption of biomarkers for early disease detection and diagnosis. Biomarkers, which are measurable indicators of biological processes or disease states, play a crucial role in identifying diseases at their earliest stages, allowing for timely intervention and improved patient outcomes. The demand for reliable and non-invasive biomarker technologies is on the rise, with a focus on enhancing diagnostic accuracy and facilitating precision medicine approaches.

Technological advancements are at the forefront of shaping the Biomarker Technologies market trends. Innovations in omics technologies, including genomics, proteomics, and metabolomics, have significantly expanded the repertoire of potential biomarkers. High-throughput sequencing, mass spectrometry, and other advanced analytical techniques enable the identification of novel biomarkers and provide a deeper understanding of the molecular basis of diseases. This trend is driving the development of more sophisticated and comprehensive biomarker panels that offer valuable insights into various health conditions.

Another significant trend is the integration of artificial intelligence (AI) and machine learning in biomarker analysis. The vast amount of data generated by biomarker technologies requires advanced analytical tools to derive meaningful insights. AI algorithms can process complex datasets, identify patterns, and predict disease risks with high accuracy. This trend enhances the efficiency and reliability of biomarker-based diagnostics, contributing to the advancement of personalized and predictive medicine.

Furthermore, there is a growing focus on liquid biopsy as a non-invasive method for biomarker detection. Liquid biopsies involve the analysis of circulating biomarkers, such as circulating tumor DNA (ctDNA) and exosomes, in blood or other bodily fluids. This approach offers a minimally invasive alternative to traditional tissue biopsies and is particularly valuable in cancer diagnostics, allowing for real-time monitoring of disease progression and treatment response.

The market is witnessing increased collaboration between academia, research institutions, and industry players to validate and standardize biomarker technologies. Collaborative efforts aim to address challenges related to biomarker reproducibility, variability, and standardization across different platforms. Standardizing protocols and ensuring the reliability of biomarker data are essential for promoting the widespread adoption of biomarker technologies in clinical practice.

Moreover, there is a trend towards the development of companion diagnostics in conjunction with targeted therapies. Biomarker-based companion diagnostics help identify patients who are most likely to respond to specific treatments, enabling a more personalized and effective approach to therapy. This trend aligns with the broader shift towards precision medicine, where treatment decisions are tailored to the individual characteristics of each patient, leading to improved treatment outcomes and reduced adverse effects.

Despite these positive trends, challenges such as regulatory complexities and the need for extensive validation of biomarkers for clinical use persist. Regulatory agencies play a crucial role in ensuring the safety and efficacy of biomarker-based diagnostics, and navigating the regulatory landscape can be a significant hurdle for biomarker technology developers. Addressing these challenges requires ongoing collaboration between regulatory bodies and industry stakeholders to establish clear guidelines and standards for biomarker validation and implementation.

Leave a Comment