Rising Demand for Diagnostic Tools

The Biological Stains Market experiences a notable surge in demand for diagnostic tools, driven by the increasing prevalence of chronic diseases and the need for accurate diagnostic methods. As healthcare systems evolve, the reliance on histological and cytological techniques for disease diagnosis becomes more pronounced. The market for biological stains is projected to grow at a compound annual growth rate of approximately 6.5% over the next few years, reflecting the critical role these stains play in enhancing diagnostic accuracy. Furthermore, advancements in staining protocols and the introduction of novel stains are likely to bolster the market, as they facilitate better visualization of cellular structures and abnormalities. This trend underscores the importance of biological stains in modern diagnostics, positioning the Biological Stains Market as a vital component of healthcare innovation.

Rising Awareness of Personalized Medicine

The Biological Stains Market is positively impacted by the rising awareness of personalized medicine, which emphasizes tailored treatment approaches based on individual patient profiles. Biological stains are integral to the development of personalized medicine, as they enable the detailed analysis of cellular and molecular characteristics of diseases. This analysis is crucial for identifying specific biomarkers that can guide treatment decisions. As healthcare providers increasingly adopt personalized medicine strategies, the demand for biological stains is likely to grow. The market is projected to expand as more healthcare institutions invest in technologies that support personalized diagnostics. This trend not only enhances patient outcomes but also reinforces the role of biological stains in the evolving landscape of medical science, positioning the Biological Stains Market as a key player in the future of healthcare.

Increasing Application in Forensic Science

The Biological Stains Market is witnessing a growing application of biological stains in forensic science, which is becoming increasingly important in criminal investigations. The ability to detect and analyze biological materials, such as blood, saliva, and other bodily fluids, is crucial for solving crimes. Biological stains facilitate the identification of these materials, providing vital evidence in forensic cases. As forensic science continues to advance, the demand for specialized stains that can enhance the visibility of biological samples is likely to rise. This trend is supported by the increasing number of forensic laboratories and the growing emphasis on forensic evidence in legal proceedings. Consequently, the Biological Stains Market is expected to benefit from this expanding application, highlighting the versatility and importance of biological stains in various fields.

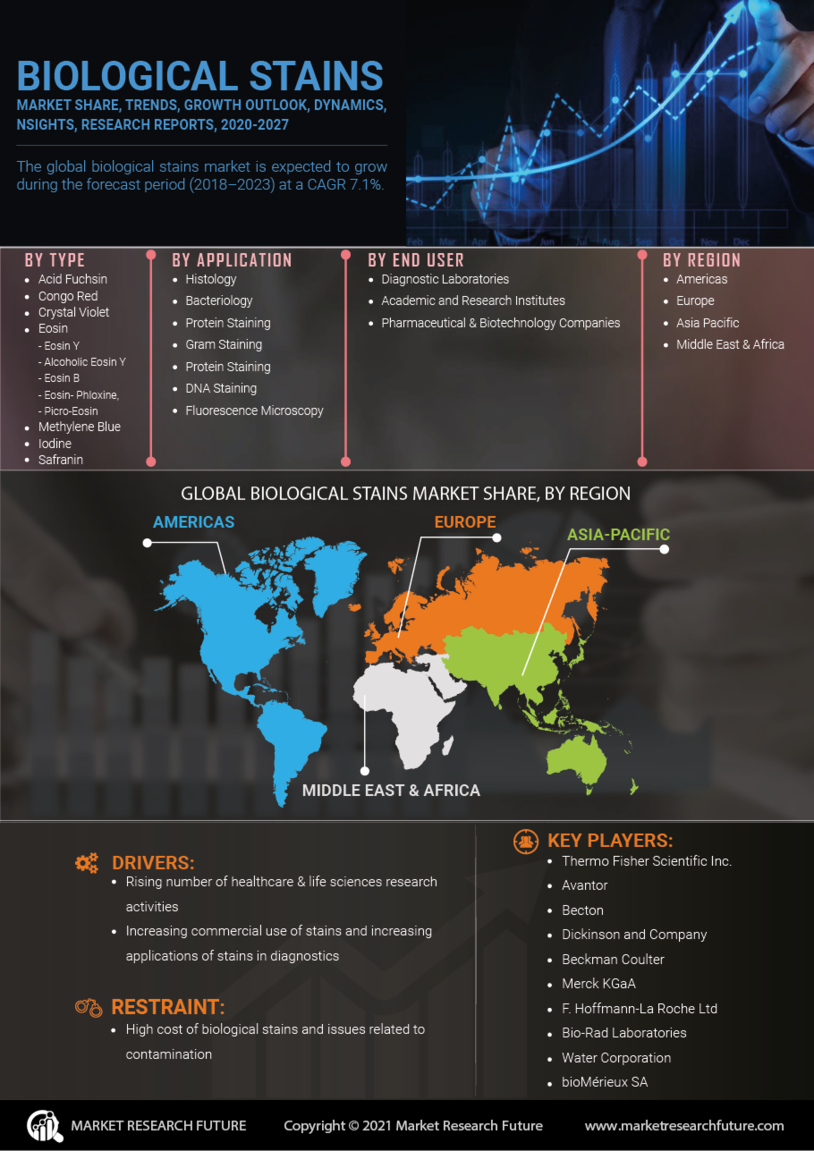

Growth in Research and Development Activities

The Biological Stains Market is significantly influenced by the expansion of research and development activities across various sectors, including pharmaceuticals and biotechnology. Increased funding for research initiatives, particularly in the fields of cancer research and drug development, propels the demand for biological stains. These stains are essential for visualizing cellular components and understanding disease mechanisms, thereby aiding in the development of new therapeutic strategies. According to recent estimates, the global investment in life sciences research is expected to reach over 200 billion USD by 2026, which will likely enhance the utilization of biological stains in laboratory settings. This growth in R&D not only drives innovation in staining techniques but also expands the application scope of biological stains, reinforcing their significance in the Biological Stains Market.

Technological Innovations in Staining Methods

Technological innovations play a pivotal role in shaping the Biological Stains Market, as advancements in staining methods enhance the efficiency and effectiveness of biological analysis. The introduction of automated staining systems and high-throughput screening techniques allows for faster and more accurate staining processes, which is particularly beneficial in clinical laboratories. Moreover, the development of new stains with improved specificity and sensitivity is likely to attract researchers and clinicians alike. For instance, the emergence of fluorescent stains has revolutionized cellular imaging, enabling real-time observation of cellular processes. As these technologies continue to evolve, they are expected to drive the growth of the Biological Stains Market, making it an attractive area for investment and innovation.