North America : Market Leader in Bioinformatics

North America is poised to maintain its leadership in the Bioinformatics Consulting Services Market, holding a significant market share of 2.5 in 2024. The region's growth is driven by robust investments in biotechnology and healthcare, alongside increasing demand for personalized medicine. Regulatory support from agencies like the FDA further catalyzes innovation and adoption of bioinformatics solutions, enhancing research capabilities and patient outcomes.

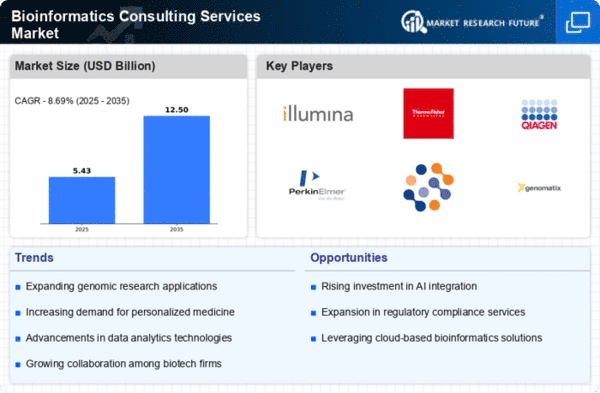

The competitive landscape is characterized by the presence of major players such as Illumina, Thermo Fisher Scientific, and DNAnexus, which are at the forefront of technological advancements. The U.S. and Canada are leading countries, with a strong focus on genomics and data analytics. This concentration of expertise and resources positions North America as a hub for bioinformatics consulting, attracting global clients seeking cutting-edge solutions.

Europe : Emerging Bioinformatics Hub

Europe is rapidly evolving as a significant player in the Bioinformatics Consulting Services Market, with a market size of 1.5 in 2024. The region benefits from strong governmental support and funding for research initiatives, particularly in genomics and personalized medicine. Regulatory frameworks, such as the EU's General Data Protection Regulation (GDPR), are shaping the landscape, ensuring data privacy while promoting innovation in bioinformatics solutions.

Leading countries like Germany, the UK, and France are at the forefront of this growth, hosting key players such as Qiagen and Eurofins Scientific. The competitive environment is marked by collaborations between academia and industry, fostering innovation and enhancing service offerings. As Europe continues to invest in bioinformatics, it is set to become a central hub for consulting services in the field.

Asia-Pacific : Rapidly Growing Market

The Asia-Pacific region is witnessing a rapid expansion in the Bioinformatics Consulting Services Market, with a market size of 0.8 in 2024. This growth is fueled by increasing investments in healthcare infrastructure and a rising focus on genomics and biotechnology. Countries like China and India are leading the charge, supported by favorable government policies and initiatives aimed at enhancing research capabilities in bioinformatics.

The competitive landscape is becoming increasingly dynamic, with local firms emerging alongside established global players. The presence of companies like Genomatix and PerkinElmer highlights the region's potential. As demand for bioinformatics services grows, Asia-Pacific is positioning itself as a key player in the global market, attracting investments and fostering innovation in the field.

Middle East and Africa : Emerging Market Potential

The Middle East and Africa region is at the nascent stage of development in the Bioinformatics Consulting Services Market, with a market size of 0.2 in 2024. However, there is a growing recognition of the importance of bioinformatics in healthcare and research, driven by increasing investments in biotechnology and healthcare infrastructure. Governments are beginning to support initiatives that promote research and development in this field, which is crucial for addressing regional health challenges.

Countries like South Africa and the UAE are emerging as key players, with a focus on building capabilities in bioinformatics. The competitive landscape is still developing, but there is potential for growth as local firms and international players seek to establish a presence. As awareness and demand for bioinformatics services increase, the region is poised for significant advancements in the coming years.