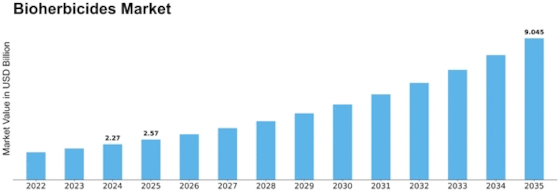

Bioherbicides Size

Bioherbicides Market Growth Projections and Opportunities

In the evolving agricultural landscape, bioherbicides offer a sustainable and eco friendly weed management option. Bioherbicides fit organic farming and sustainable crop management well. Organic farming and consumer environmental consciousness in North America will drive the bioherbicides market over the projected period. Asia-Pacific is expected to have the greatest CAGR throughout the predicted period. China, Japan, and Australia are predicted to grow rapidly, expanding the regional bioherbicides market.

The growing demand for organic and non GMO products affects market dynamics. Organic food is becoming more popular worldwide. This consumer change affects farmers, who use bioherbicides in organic farming. As organic agriculture grows, bioherbicides' natural and ecologically friendly weed control helps the market. The complementary link between consumer preferences and farmers' bioherbicide adoption shapes market dynamics, showing a dedication to sustainable and health-conscious choices.

Market dynamics are heavily influenced by regulations. Due to environmental and health concerns, governments worldwide are restricting synthetic pesticide use. The Bioherbicides market benefits from this regulatory environment since these products meet changing criteria. Bioherbicide manufacturers comply with regulations and contribute to market dynamics. Compliance shapes the market and promotes sustainable and responsible agriculture.

Limited farmer understanding and perceived inferior efficacy compared to synthetic pesticides affect market dynamics. Bioherbicides are eco-friendly and effective, however their efficacy may be lower than synthetic equivalents. This problem demands continuing research and development to improve bioherbicide efficacy and debunk myths. To overcome acceptance challenges, farmers must be educated about bioherbicide advantages and correct use. Market dynamics adapt to farmer and stakeholder perspectives as awareness and product formulations improve.

Bioherbicides research and development drive market dynamics. Bioherbicide effectiveness and adaptability are improved by researching novel active ingredients, formulations, and delivery mechanisms. Microbial strains, plant-derived chemicals, and application methods provide farmers more weed-control options. Research & development drives the industry by developing new and better bioherbicide solutions. Market dynamics change as the sector responds to new findings, giving farmers more sustainable options.

Finally, sustainability, regulation, and customer preferences shape the bioherbicides business. Global trend toward sustainable agriculture, increased demand for organic products, and regulatory initiatives to limit synthetic pesticide usage drive market dynamics. The Bioherbicides market promotes ecologically friendly weed management despite difficulties. Research and development and awareness will help the sector maintain its good trajectory and assist sustainable agriculture globally.

Leave a Comment