Growing E-Bike Market

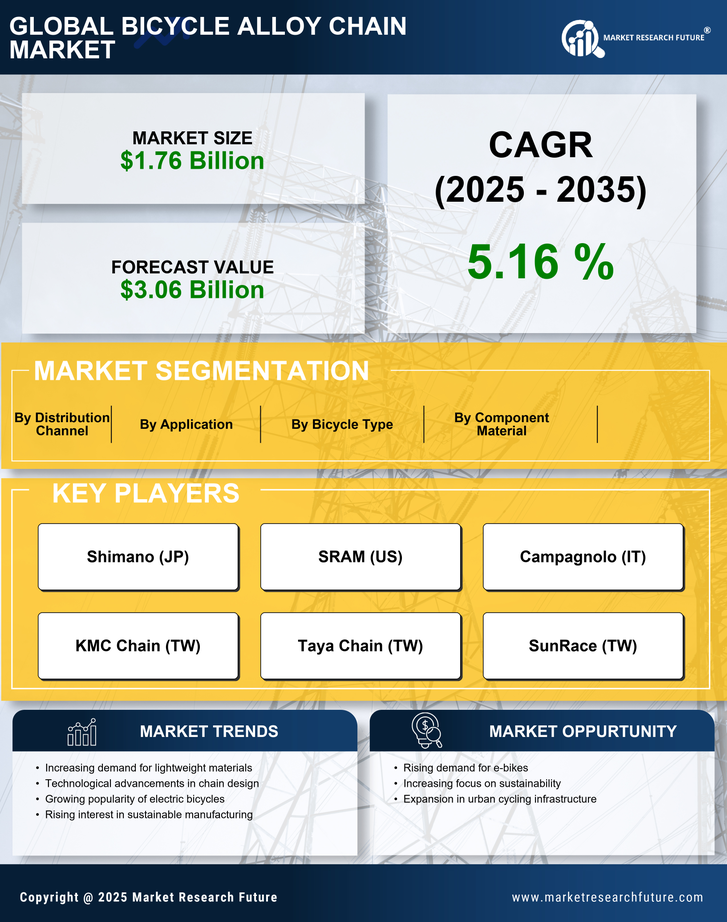

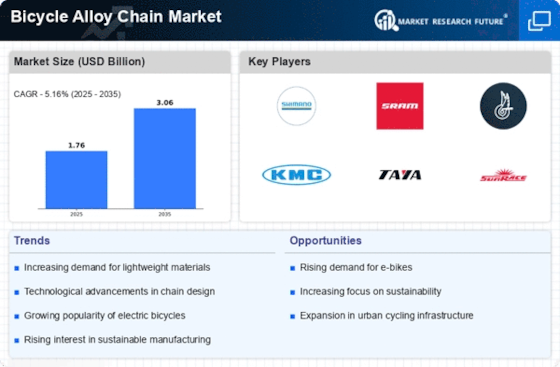

The Bicycle Alloy Chain Market is poised to benefit from the rapid expansion of the e-bike segment. As electric bicycles gain popularity due to their convenience and efficiency, the demand for robust and reliable alloy chains is expected to rise. E-bikes typically require chains that can withstand higher torque and stress, which presents an opportunity for manufacturers to innovate and develop specialized alloy chains tailored for this market. Recent reports indicate that the e-bike market is projected to grow at a compound annual growth rate of 8% over the next five years, further driving the demand for high-performance components. This trend underscores the potential for the Bicycle Alloy Chain Market to capitalize on the growing e-bike segment.

Rising Demand for Lightweight Components

The Bicycle Alloy Chain Market is experiencing a notable increase in demand for lightweight components, driven by the growing preference for performance-oriented bicycles. As cyclists seek to enhance their riding experience, manufacturers are focusing on producing alloy chains that offer reduced weight without compromising strength. This trend is reflected in the market data, which indicates that lightweight bicycle components are projected to grow at a compound annual growth rate of approximately 5% over the next five years. The emphasis on performance has led to innovations in materials and manufacturing processes, further propelling the Bicycle Alloy Chain Market forward. Additionally, the integration of advanced alloys is likely to enhance durability, making these chains more appealing to both competitive and recreational cyclists.

Focus on Customization and Personalization

The Bicycle Alloy Chain Market is increasingly influenced by consumer preferences for customization and personalization. As cyclists seek to express their individuality through their bicycles, the demand for customized alloy chains is on the rise. Manufacturers are responding by offering a variety of options in terms of colors, designs, and specifications, allowing consumers to tailor their bicycles to their unique tastes. This trend is supported by market data indicating that personalized bicycle components can command a premium price, enhancing profitability for manufacturers. As the Bicycle Alloy Chain Market adapts to these changing consumer preferences, it is likely to see a shift towards more diverse product offerings, catering to a broader range of cyclists.

Increased Participation in Cycling Activities

The Bicycle Alloy Chain Market is benefiting from a surge in cycling participation across various demographics. This increase is attributed to a growing awareness of health and environmental benefits associated with cycling. Recent statistics suggest that cycling participation rates have risen by over 15% in urban areas, as more individuals opt for bicycles as a primary mode of transportation. This trend not only boosts the demand for bicycles but also elevates the need for high-quality components, including alloy chains. As consumers become more discerning about the performance and longevity of their bicycles, the Bicycle Alloy Chain Market is likely to see sustained growth, driven by the need for reliable and efficient components.

Technological Innovations in Chain Manufacturing

The Bicycle Alloy Chain Market is witnessing a wave of technological innovations that are reshaping the manufacturing landscape. Advances in metallurgy and production techniques are enabling manufacturers to create alloy chains that are not only lighter but also more resilient. For instance, the introduction of new alloy compositions has led to chains that exhibit superior wear resistance and tensile strength. Market data indicates that the adoption of these advanced manufacturing processes could lead to a 10% reduction in production costs, thereby enhancing profitability for manufacturers. As these innovations continue to emerge, they are expected to play a crucial role in driving the Bicycle Alloy Chain Market forward, catering to the evolving needs of cyclists.