Beauty Personal Care Packaging Market Summary

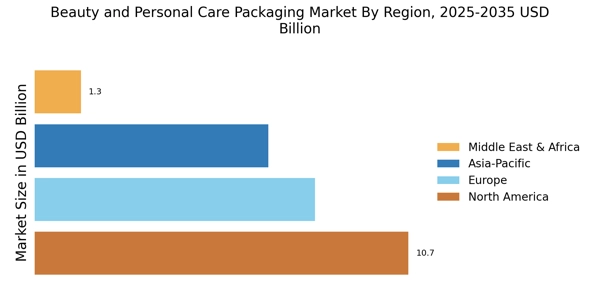

As per Market Research Future analysis, the Beauty and Personal Care Packaging Market was estimated at 26.62 USD Billion in 2024. The Beauty and Personal Care Packaging industry is projected to grow from 27.7 USD Billion in 2025 to 41.29 USD Billion by 2035, exhibiting a compound annual growth rate (CAGR) of 4.07% during the forecast period 2025 - 2035

Key Market Trends & Highlights

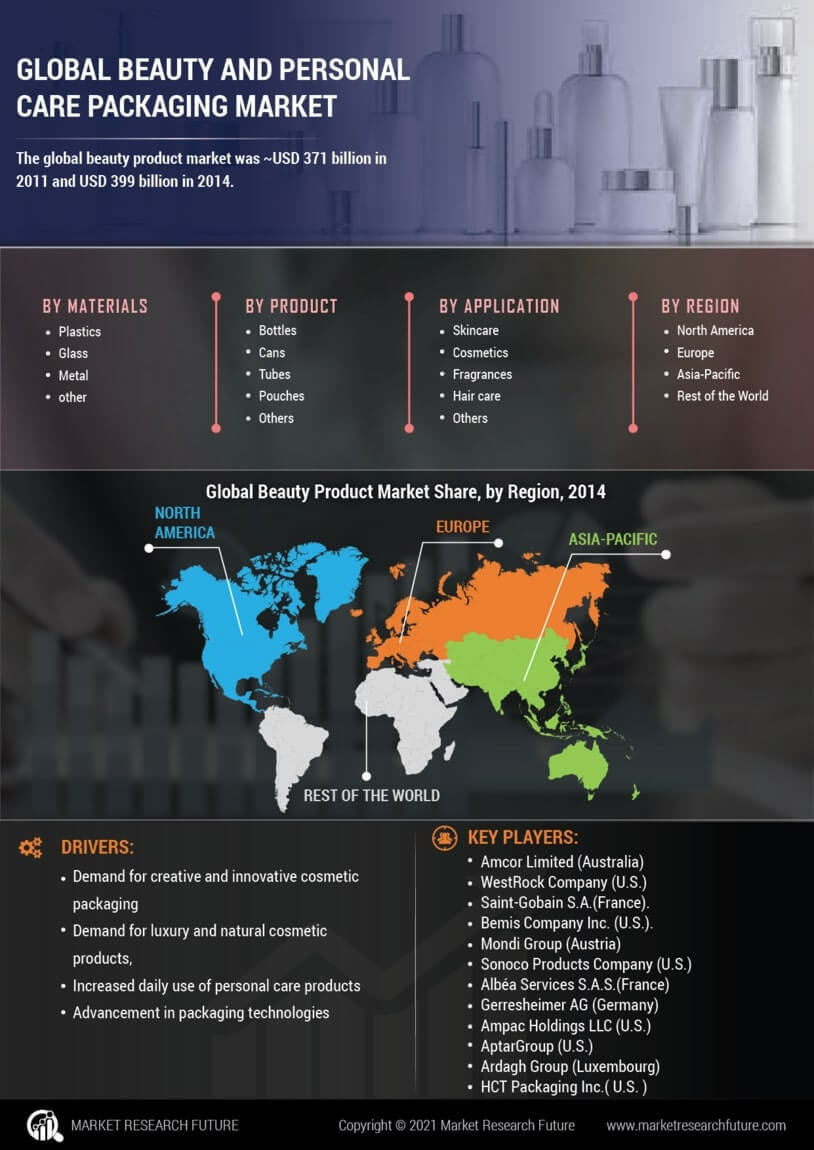

The Beauty and Personal Care Packaging Market is evolving towards sustainability and personalization, driven by technological advancements and changing consumer preferences.

- Sustainable packaging solutions are increasingly prioritized by brands in North America, the largest market for beauty and personal care products.

- Personalization in packaging is gaining traction, particularly in the Asia-Pacific region, which is recognized as the fastest-growing market.

- E-commerce is driving innovations in packaging, with brands adapting to online shopping trends to enhance customer experience.

- Technological advancements and regulatory compliance are major drivers, influencing the shift towards sustainable and personalized packaging solutions.

Market Size & Forecast

| 2024 Market Size | 26.62 (USD Billion) |

| 2035 Market Size | 41.29 (USD Billion) |

| CAGR (2025 - 2035) | 4.07% |

Major Players

Amcor (AU), Berry Global (US), Mondi (GB), Sealed Air (US), Albea (FR), Crown Holdings (US), Graham Packaging (US), Silgan Holdings (US), AptarGroup (US)