North America : Market Leader in MRO Services

North America is poised to maintain its leadership in the Batch Process Equipment Maintenance and MRO Services Market, holding a significant market share of 12.5 in 2024. The region's growth is driven by increasing industrial automation, stringent regulatory standards, and a focus on operational efficiency. The demand for advanced maintenance solutions is further fueled by the need for minimizing downtime and enhancing productivity across various sectors.

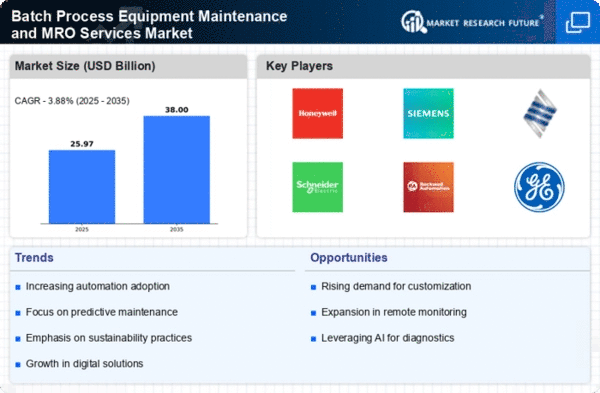

The competitive landscape in North America is robust, featuring key players such as Honeywell, Emerson, and Rockwell Automation. These companies are leveraging innovative technologies and strategic partnerships to enhance service offerings. The U.S. stands out as the leading country, supported by a strong manufacturing base and significant investments in infrastructure. This dynamic environment positions North America as a critical hub for MRO services in the batch processing sector.

Europe : Emerging Market with Growth Potential

Europe is witnessing a growing demand for Batch Process Equipment Maintenance and MRO Services, with a market size of 7.5 in 2024. The region's growth is driven by increasing investments in sustainable manufacturing practices and the adoption of Industry 4.0 technologies. Regulatory frameworks aimed at enhancing safety and efficiency are also pivotal in shaping market dynamics, encouraging companies to invest in advanced maintenance solutions.

Leading countries in Europe, such as Germany and France, are at the forefront of this market, supported by established players like Siemens and Schneider Electric. The competitive landscape is characterized by a mix of local and international firms, all vying for market share. The European market is expected to continue evolving, driven by innovation and a focus on sustainability in manufacturing processes.

Asia-Pacific : Rapidly Growing MRO Services Sector

Asia-Pacific is emerging as a significant player in the Batch Process Equipment Maintenance and MRO Services Market, with a market size of 4.5 in 2024. The region's growth is fueled by rapid industrialization, increasing foreign investments, and a rising focus on operational efficiency. Governments are implementing favorable policies to boost manufacturing capabilities, which in turn drives demand for maintenance services across various sectors.

Countries like China and Japan are leading the charge, with major companies such as Mitsubishi Electric and ABB establishing a strong presence. The competitive landscape is becoming increasingly dynamic, with both local and international players striving to capture market share. As the region continues to develop, the demand for advanced MRO services is expected to rise significantly, reflecting the growing industrial base.

Middle East and Africa : Untapped Market Opportunities

The Middle East and Africa represent an emerging frontier in the Batch Process Equipment Maintenance and MRO Services Market, with a market size of 0.5 in 2024. The region is characterized by a growing industrial sector, driven by investments in oil and gas, manufacturing, and infrastructure development. Regulatory initiatives aimed at enhancing operational efficiency are also contributing to the demand for maintenance services, albeit at a slower pace compared to other regions.

Countries like South Africa and the UAE are leading the way, with a focus on diversifying their economies and improving industrial capabilities. The competitive landscape is still developing, with opportunities for both local and international players to establish a foothold. As the region continues to evolve, the demand for MRO services is expected to grow, driven by ongoing industrialization efforts.