Growth in Construction Activities

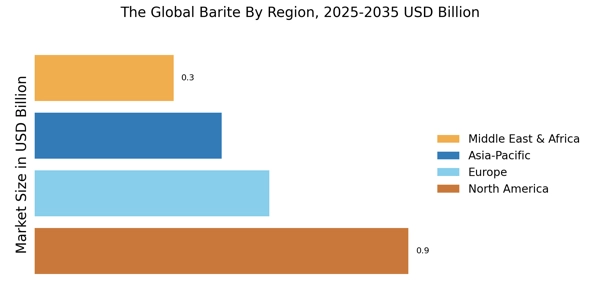

The construction industry is experiencing a resurgence, which appears to be positively influencing The Global Barite Industry. Barite Market is utilized in various construction applications, including as a filler in cement and as a component in concrete. The increasing urbanization and infrastructure development projects across emerging economies are likely to drive the demand for barite. For instance, the construction sector in Asia-Pacific has been expanding rapidly, with significant investments in residential and commercial projects. This growth is expected to create a substantial demand for barite, as it contributes to the durability and strength of construction materials. Additionally, the trend towards sustainable building practices may further enhance the use of barite in eco-friendly construction solutions.

Rising Demand in Oil and Gas Sector

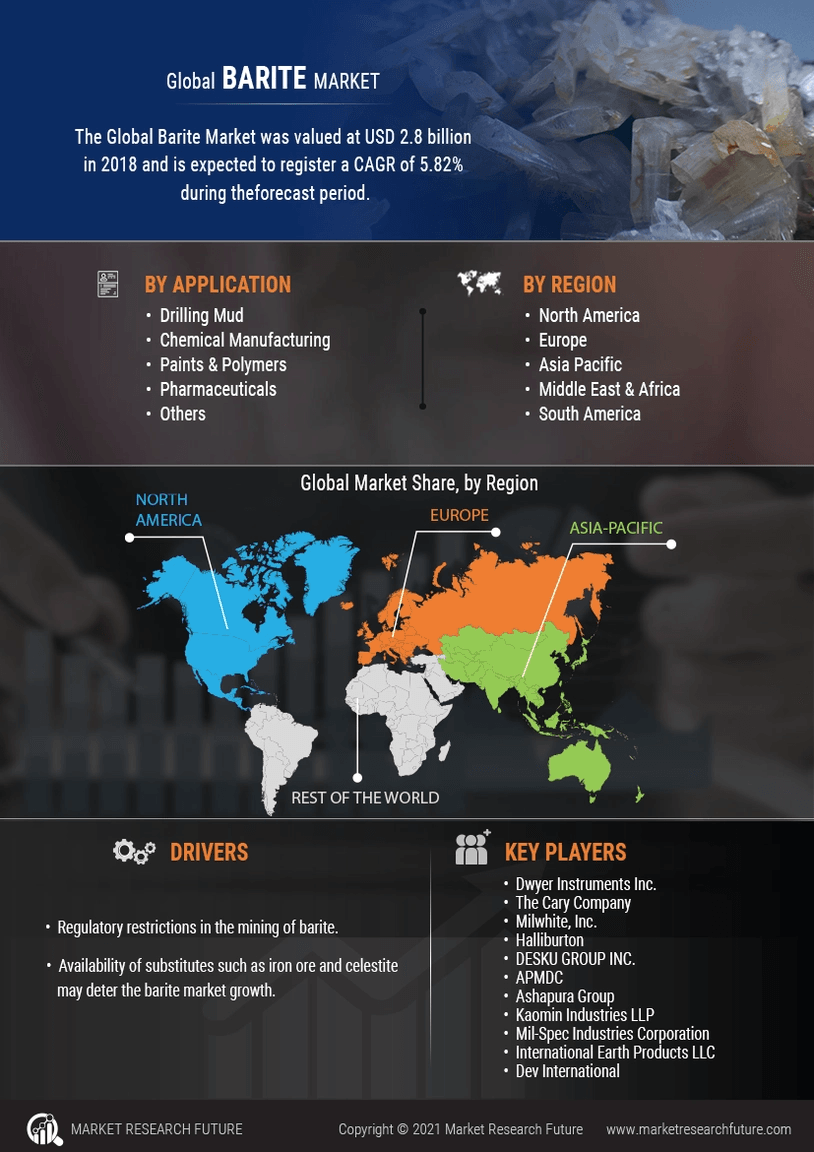

The oil and gas sector remains a primary driver for The Global Barite Industry, as barite is extensively utilized as a weighting agent in drilling fluids. The increasing exploration and production activities in offshore and onshore oil fields are likely to bolster the demand for barite. In recent years, the global oil production has shown a steady increase, with estimates suggesting a rise in drilling activities, particularly in regions such as North America and the Middle East. This trend indicates a potential growth trajectory for barite consumption, as companies seek to enhance drilling efficiency and reduce costs. Furthermore, the ongoing investments in energy infrastructure may further stimulate the demand for barite, thereby reinforcing its significance in the oil and gas sector.

Technological Innovations in Mining

Technological advancements in mining techniques are poised to impact The Global Barite Industry positively. Innovations such as automated mining equipment and advanced processing technologies are likely to enhance the efficiency of barite extraction and processing. These developments may lead to reduced operational costs and improved product quality, making barite more competitive in various applications. Moreover, the integration of data analytics and artificial intelligence in mining operations could optimize resource management and increase production rates. As mining companies adopt these technologies, the overall supply chain for barite may become more streamlined, potentially leading to a more stable market environment. This evolution in mining practices could also attract new investments into the barite sector, further stimulating market growth.

Regulatory Support for Mining Operations

Regulatory frameworks that support mining operations are crucial for the stability of The Global Barite Industry. Governments are increasingly recognizing the importance of mineral resources, including barite, for economic development. Policies aimed at facilitating exploration and production activities can significantly impact the market dynamics. For instance, streamlined permitting processes and incentives for sustainable mining practices may encourage investment in barite mining projects. Additionally, regulatory support for environmental management can enhance the industry's reputation and promote responsible mining practices. As countries seek to balance economic growth with environmental sustainability, the regulatory landscape will likely play a pivotal role in shaping the future of the barite market.

Increasing Use in Pharmaceuticals and Healthcare

The pharmaceutical and healthcare sectors are emerging as new avenues for The Global Barite Industry. Barite Market is utilized in medical imaging, particularly in barium swallow tests and other diagnostic procedures. The growing emphasis on healthcare and advancements in medical technologies are likely to drive the demand for barite in these applications. As the global population ages and healthcare needs expand, the requirement for diagnostic imaging is expected to rise. This trend may lead to an increased consumption of barite in the healthcare sector, thereby diversifying its applications beyond traditional uses. Furthermore, the ongoing research into new medical applications for barite could further enhance its market potential in the pharmaceutical industry.