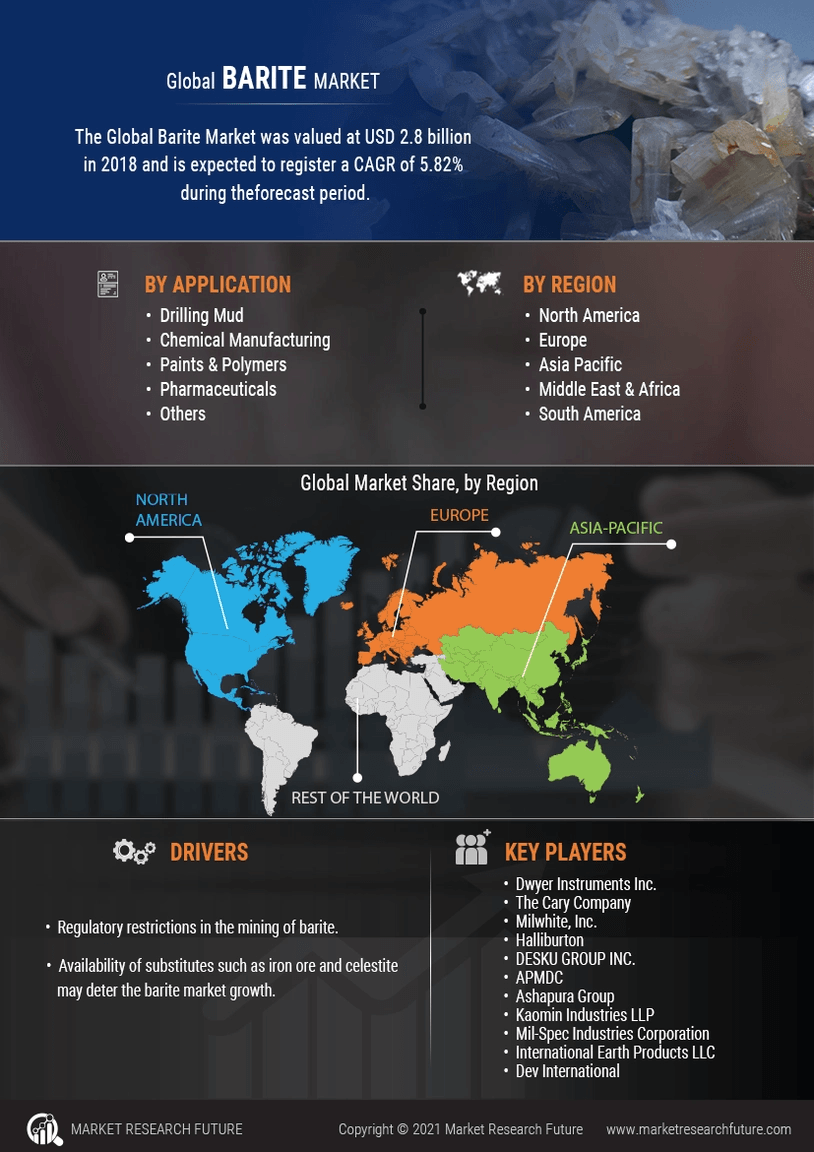

Leading market players are investing heavily in research and development in order to expand their product lines, which will help the Barite Market, grow even more. Market participants are also undertaking a variety of strategic activities to expand their footprint, with important market developments including new product launches, contractual agreements, mergers and acquisitions, higher investments, and collaboration with other organizations. To expand and survive in a more competitive and rising market climate, Barite industry must offer cost-effective items.

Manufacturing locally to minimize operational costs is one of the key business tactics used by manufacturers in the Barite industry to benefit clients and increase the market sector. In recent years, the Barite industry has offered some of the most significant advantages to medicine.

Major players in the Barite Market, including The Cary Company (US),

Milwhite, Inc. (US), Halliburton (US), DESKU GROUP INC. (US), APMDC (India), Ashapura Group (India), Kaomin Industries LLP (India), Mil-Spec Industries Corporation (US),

International Earth Products LLC (US), and Dev International (India), and others, are attempting to increase market demand by investing in research and development operations.

Cary began as a railroad village and became known as an educational center in the late 19th and early 20th centuries.

In April Cary High School became the first state-funded public high school in North Carolina. The creation of the nearby Research Triangle Park in 1959 resulted in Cary's population doubling in a few years, tripling in the 1970s, and doubling in both the 1980s and 1990s. Cary is now the location of numerous technology companies, including the world's largest privately held software company.

In Cary, 68.4% of adults hold a bachelor's degree or higher, which is higher than the state average. In 2021, it was identified as the safest mid-sized place to live in the United States, based on 2019 FBI data. It also has a median household income of $113,782, higher than the county average of $88,471 or the state average of $60,516.

Halliburton Company is an American multinational corporation responsible for most of the world's hydraulic fracturing operations. In 2009, it was the world's second-largest oil field service company. It employs approximately 55,000 people through its hundreds of subsidiaries, affiliates, branches, brands, and divisions in more than 70 countries. The company, though incorporated in the United States, has dual headquarters located in Houston and in Dubai. Halliburton's major business segment is the Energy Services Group (ESG). KBR, a public company, and former Halliburton subsidiary, is a major construction company of refineries, oil fields, pipelines, and chemical plants.

Halliburton announced on April 5, 2007, that it had sold the division and severed its corporate relationship with KBR, which had been its contracting, engineering, and construction unit as a part of the company. The company has been criticized for its involvement in numerous controversies, including its involvement with Dick Cheney - as U.S.

Secretary of Defense, then CEO of the company, then Vice President of the United States - and the Iraq War, and the Deepwater Horizon.Pemex Exploracion y Produccion PEP sought authorization from Mexico’s National Hydrocarbons Commission CNH regarding its plans both onshore and offshore in January 2022.Pemex Exploracion y Produccion proposed these plans which involved an investment worth $800m.Thus,Pemex will explore and produce within these areas following this approval granted by CNH thereby boosting hydrocarbon resources development within Mexico.Tor Minerals through its United Minerals and Properties division acquired Cimbar Performance Minerals during April this year taking over Tor Minerals’ US Barite Market & ATH Manufacturing Business.By buying it, Cimbar also gained specialty minerals including flame retardants and titanium dioxide.Titanium Dioxide (TiO2) is one such additional product line added by Cimbar into its specialty mineral business along with Flame Retardants whereby it has broadened the scope.