Regulatory Compliance

Regulatory compliance remains a critical driver in the Banking BPS Market, as financial institutions face increasing scrutiny from regulatory bodies. The need to adhere to stringent regulations, such as anti-money laundering (AML) and know your customer (KYC) requirements, compels banks to invest in BPS solutions that ensure compliance. The market for compliance-related services is expected to grow, with estimates suggesting a compound annual growth rate (CAGR) of around 10% over the next few years. This trend indicates that banks are prioritizing compliance as a strategic focus, thereby driving demand for specialized BPS services.

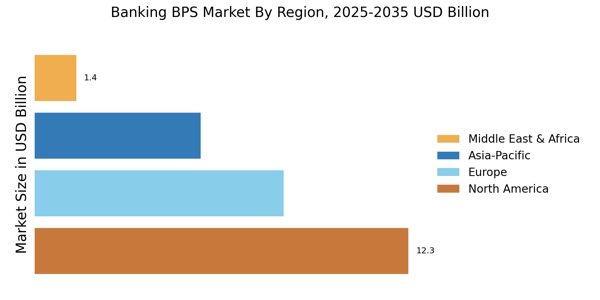

Emerging Markets Expansion

The expansion into emerging markets is a notable driver in the Banking BPS Market. As financial institutions seek to tap into new customer bases, they are increasingly looking towards regions with growing economies. This trend is particularly evident in Asia and Africa, where banking penetration is on the rise. The potential for growth in these markets is substantial, with estimates suggesting that the banking sector in these regions could grow by over 15% annually. This expansion presents opportunities for BPS providers to offer tailored solutions that cater to the unique needs of these markets, thereby driving growth in the Banking BPS Market.

Technological Advancements

The Banking BPS Market is experiencing a surge in technological advancements, which are reshaping operational frameworks. Automation, artificial intelligence, and machine learning are being integrated into banking processes, enhancing efficiency and reducing operational costs. For instance, the adoption of robotic process automation (RPA) is projected to increase productivity by up to 30% in various banking functions. This shift not only streamlines back-office operations but also allows banks to focus on core competencies. As a result, the Banking BPS Market is likely to witness a significant transformation, with technology serving as a catalyst for growth and innovation.

Customer Experience Enhancement

In the Banking BPS Market, enhancing customer experience is paramount. Financial institutions are increasingly recognizing the importance of personalized services and customer engagement strategies. By leveraging data analytics and customer insights, banks can tailor their offerings to meet individual needs. This focus on customer-centricity is expected to drive the demand for BPS solutions that facilitate better customer interactions. As a result, the market for customer experience management services within the Banking BPS Market is anticipated to expand, with projections indicating a growth rate of approximately 12% annually.

Cost Efficiency and Operational Optimization

Cost efficiency is a driving force in the Banking BPS Market, as banks seek to optimize their operations. By outsourcing non-core functions, financial institutions can reduce overhead costs and allocate resources more effectively. The trend towards operational optimization is evident, with many banks reporting savings of up to 25% through BPS partnerships. This focus on cost management is likely to propel the Banking BPS Market forward, as institutions increasingly recognize the financial benefits of outsourcing. Consequently, the demand for BPS services that enhance operational efficiency is expected to rise.