Economic Growth

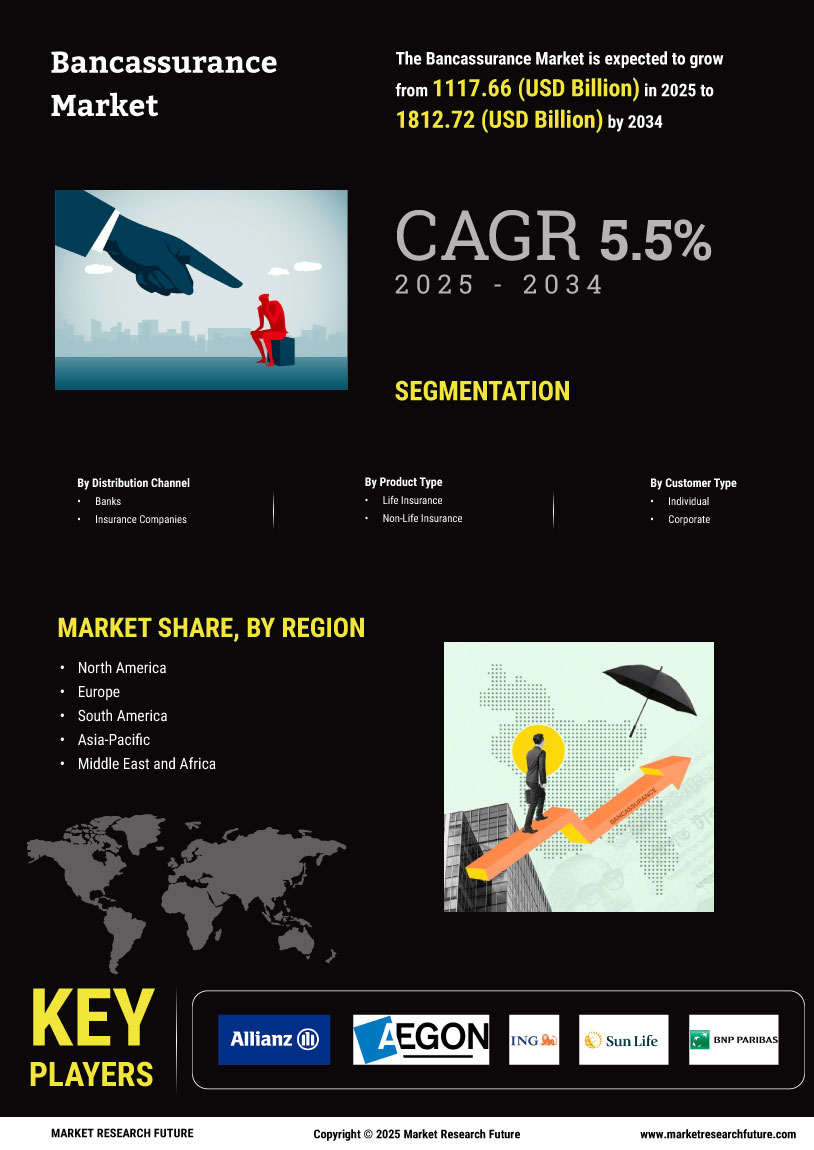

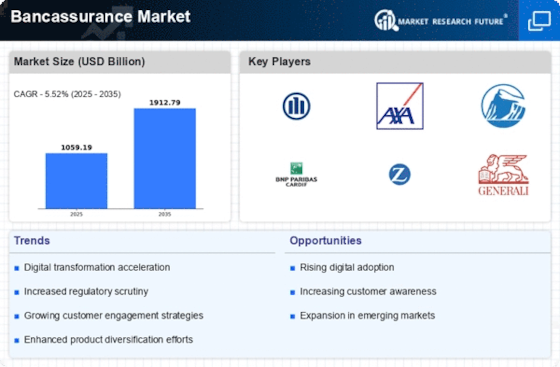

Economic growth is a pivotal driver for the Bancassurance Market, as rising incomes and increased financial literacy lead to greater demand for insurance products. In many regions, a growing middle class is becoming more aware of the importance of financial planning and risk management, which in turn fuels the demand for bancassurance solutions. Projections indicate that The Bancassurance Market could expand by 5% annually, with bancassurance capturing a significant share of this growth. As banks enhance their product offerings to include comprehensive insurance solutions, they are likely to attract a broader customer base. This economic momentum not only supports the Bancassurance Market but also encourages innovation in product development, ensuring that offerings remain relevant and competitive.

Regulatory Support

Regulatory frameworks are playing a crucial role in shaping the Bancassurance Market. Governments are increasingly recognizing the importance of bancassurance as a means to enhance financial inclusion and consumer protection. Recent regulations have streamlined the process for banks to offer insurance products, thereby encouraging collaboration between financial institutions and insurance providers. In 2025, it is anticipated that regulatory support will facilitate a 20% growth in the Bancassurance Market, as banks leverage their existing customer bases to expand insurance offerings. Moreover, compliance with evolving regulations is likely to enhance consumer trust, further driving market growth. This supportive regulatory environment not only fosters innovation but also ensures that the Bancassurance Market remains competitive and resilient in the face of emerging challenges.

Strategic Partnerships

Strategic partnerships between banks and insurance companies are emerging as a vital driver in the Bancassurance Market. These collaborations enable banks to leverage their distribution networks while insurance firms benefit from enhanced market access. In 2025, it is expected that such partnerships will account for a substantial portion of new policy sales, potentially increasing market penetration by 15%. By combining resources and expertise, banks and insurers can create innovative products that cater to diverse customer needs. Furthermore, these alliances facilitate knowledge sharing and best practices, enhancing operational efficiency within the Bancassurance Market. As competition intensifies, the ability to forge effective partnerships will likely determine the success of institutions in capturing market share and driving growth.

Technological Advancements

The Bancassurance Market is experiencing a notable transformation driven by technological advancements. The integration of artificial intelligence and machine learning into financial services has enhanced customer engagement and streamlined operations. For instance, banks are utilizing data analytics to tailor insurance products to meet specific customer needs, thereby increasing sales efficiency. In 2025, it is projected that the adoption of digital platforms in the Bancassurance Market will lead to a 30% increase in policy sales, as customers increasingly prefer online transactions. Furthermore, the use of mobile applications for policy management is likely to enhance customer satisfaction, fostering loyalty and retention. This technological shift not only improves operational efficiency but also positions banks as competitive players in the insurance sector.

Changing Consumer Preferences

Consumer preferences are evolving, significantly impacting the Bancassurance Market. Today's customers seek personalized financial solutions that integrate banking and insurance services seamlessly. Research indicates that approximately 60% of consumers prefer purchasing insurance products through their banks due to the convenience and trust associated with established financial institutions. This trend suggests that banks must adapt their offerings to align with consumer expectations, potentially leading to a 25% increase in cross-selling opportunities within the Bancassurance Market. Additionally, the rise of millennials and Gen Z as key consumers is prompting banks to innovate their product offerings, focusing on digital accessibility and sustainability. As these demographic shifts continue, the Bancassurance Market must remain agile to cater to the diverse needs of its clientele.