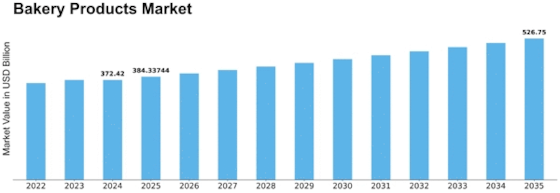

Bakery Products Size

Bakery Products Market Growth Projections and Opportunities

The process of the baking products market’s (the bakery products sector) development is influenced by a number of determining factors. Interestingly, shift in consumer preferences and dietary choices to healthy and sustainable food has proved much more important than many think. In search of time-saving and pleasure-boosting foods, bakery article with bread, cake, pastry, and cookies among the popular choices are great for the substitution of breakfast, dessert, and snack meals. In addition, there have been an increasing percent of consumers who buy products for the bakery which are natural and whole grains ingredients. This consisting of seeds and ancient grains and reflecting the trend the move towards healthy eating habits and labels foods with an intention to clean label.

Besides, the number of people population, varies as does the types of urban settlements and lifestyles cause the bakery products market to be equally affected. Fast urbanization and hectic lifestyle, mainly, drive demand for easy and snacks which, as such, could as fast food, packaged bread, and snacks may be customized. In addition to this, shifting home structures which encompasses from fewer family members number down to single person households, spurring product baby among them pack-size conformity and consumer tastes whittle down to convenience and portion-sizes, thus bakery products in this context receive preference segments.

In addition to this technological inventions in the processes and equipment that is used for baking also play a vital role in the overall growth of the market. Modernized bread making infrastructure through machinery, robotics, and production aims at increasing the speed of operation, uniformity and food quality which can lead to filling up of demands as well as offering of various types of breads. Not only that, but development of new ingredients, improved formulas as well as new baking technologies causes creation of gluten-free, vegan and allergen-free bakery products, which helps to meet different dietary requirements and address people's allergies.

The addition of health-related and wellness trends that lead to product development and market growth is another way that baking products are impacted. The market for baked goods has never been the same after consumers who demand products enriched with fibers, proteins, vitamins and minerals started to appear. Besides, they request such bakery products to have reduced sugar, fat and sodium content. Bakes are with superfoods, probiotics, and plant-based ingredients are getting fame among the health-conscious consumers because of whom the health-conscious consumers are searching for those nutritious and wholesome options which support their well-being. Moreover, another important economic factor is the consumer's income level, price sensitivity, and the spending pattern of consumers determines the bakery products market.

In addition, the increasing export to restaurants and coffee houses is driven by the increasing popularity of the artisanal and specialty production. Artisanal bakeries and craft type cafes serving delicately baked bread, pastry and sweet with premium ingredients and traditional crafting method evoke the culinary experience of authenticity and uniqueness to the consumers who are in search for the best tasting and high quality dessert. Hence there is an increase in the sale rates of bakeries that provide online bakery business and direct to consumer services are also expanding their reach and selling their products with a gourmet and artisanal flavor directly to an audience that is hungry for these products.

Leave a Comment