Increasing Health Consciousness

The baby food and infant formula Market is experiencing a notable shift towards health consciousness among parents. This trend is driven by a growing awareness of nutrition and the long-term health implications of early dietary choices. Parents are increasingly seeking products that are organic, free from artificial additives, and rich in essential nutrients. According to recent data, the demand for organic baby food has surged, with a significant percentage of parents prioritizing organic options for their infants. This shift not only reflects a desire for healthier options but also indicates a broader societal trend towards wellness and preventive health measures. As a result, manufacturers in the Baby Food and Infant Formula Market are adapting their product lines to meet these evolving consumer preferences, potentially leading to increased market growth.

Increased Focus on Sustainability

Sustainability has emerged as a pivotal driver in the Baby Food and Infant Formula Market. Consumers are increasingly concerned about the environmental impact of their purchasing decisions, leading to a demand for sustainable packaging and ethically sourced ingredients. Companies are responding by adopting eco-friendly practices, such as using biodegradable packaging materials and sourcing ingredients from sustainable farms. This shift not only appeals to environmentally conscious consumers but also aligns with regulatory trends aimed at reducing waste and promoting sustainability in food production. As the Baby Food and Infant Formula Market embraces these practices, it is likely to attract a broader customer base, particularly among millennials and Gen Z parents who prioritize sustainability in their buying choices.

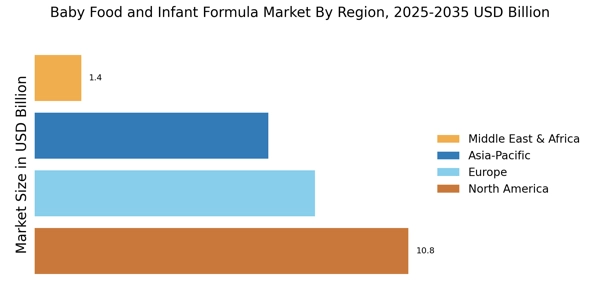

Rising Birth Rates in Emerging Economies

The Baby Food and Infant Formula Market is witnessing a rise in demand due to increasing birth rates in several emerging economies. As more families are formed, the need for baby food and infant formula is expected to grow correspondingly. Data indicates that regions with higher birth rates are also experiencing a surge in disposable income, allowing parents to invest in premium baby food products. This trend is particularly evident in countries where urbanization is on the rise, leading to changes in lifestyle and dietary habits. Consequently, manufacturers are focusing on these markets, tailoring their offerings to meet local preferences and nutritional needs. This demographic shift presents a significant opportunity for growth within the Baby Food and Infant Formula Market, as companies seek to capitalize on the expanding consumer base.

Technological Advancements in Production

Technological advancements are playing a crucial role in shaping the Baby Food and Infant Formula Market. Innovations in food processing and preservation techniques have enabled manufacturers to enhance product quality while maintaining nutritional integrity. For instance, the use of advanced sterilization methods ensures that products remain safe and shelf-stable without compromising their nutritional value. Additionally, the integration of smart technology in production processes allows for better quality control and efficiency. This not only reduces waste but also meets the rising consumer demand for transparency in food sourcing and production. As these technologies continue to evolve, they are likely to drive further growth in the Baby Food and Infant Formula Market, as companies strive to offer superior products that align with consumer expectations.

Growing Influence of Social Media and Online Communities

The influence of social media and online communities is reshaping the Baby Food and Infant Formula Market. Parents increasingly turn to social media platforms for advice, recommendations, and product reviews, significantly impacting their purchasing decisions. This trend has led to the rise of influencer marketing, where brands collaborate with parenting influencers to reach a wider audience. Additionally, online communities provide a space for parents to share experiences and discuss product efficacy, further driving brand awareness and loyalty. As a result, companies in the Baby Food and Infant Formula Market are investing in digital marketing strategies to engage with consumers effectively. This shift towards online engagement not only enhances brand visibility but also fosters a sense of community among parents, potentially leading to increased sales and market penetration.