Baby Cradle Size

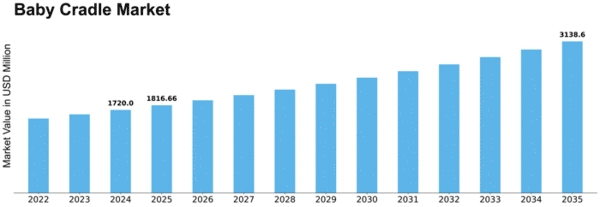

Baby Cradle Market Growth Projections and Opportunities

The market dynamics for the baby cradle are determined by several factors that govern its trends and developments within the childcare and parenting spheres. One significant milestone is the increased focus on infant safety and comfort. Baby cradles are becoming very popular among parents looking for promise of safe baby sleep solutions. The continuing growth of the baby cradle market is since many parents are especially interested in providing their children with a place for sleeping which will be safe and comfortable. Demographic factors play an important role in the baby cradle market. Parental age, lifestyle and cultural preferences determine the kinds of cradle designs as well as characteristics that parents desire for their infants. Since these brands understand the needs of various parental demographics, they can offer a broad array of cradle styles materials and functionalities that relate to different consumer niche thereby ensuring their relevance on this market while maintaining consumers’ interest in what the brand offers. The baby cradle market is affected by several economic factors, such as disposable incomes and the amount of money that consumers spend on baby products. Economic stead is also often followed by higher disposable income where the consumer tends to spend more on non-essential items such as fancy or technology-based baby cradles. During the periods of economic boom, consumers may be more willing to purchase durable and rich feature cradles. On the contrary, economic recessions could affect consumer spending on items that are not essential for daily living use and can influence purchasing habits in relation to baby cradle market. Brand image and marketing strategies are key factors that shape the consumer’s perceptions in baby cradle market. Strong brand loyalty is often present amongst well-established baby product brands as well as those with a good reputation of producing high-quality, safe, and fashionable cradles. Brand visibility and consumer choices can be influenced by effective marketing campaigns that showcase features like breathable materials, adjustable settings, or convertible designs in the highly competitive baby cradle market. The market is growing due to technological innovations in cradle design and materials. Advanced and improved features like smart sensors, comfortable rocking mechanisms and environmentally friendly materials increase the effectiveness as well as attractiveness of baby cradles. Technological advancements also influence the appearance of cradles as well, with more modern and stylish designs to suit current parental tastes.

Leave a Comment