Rise of Remote Work Solutions

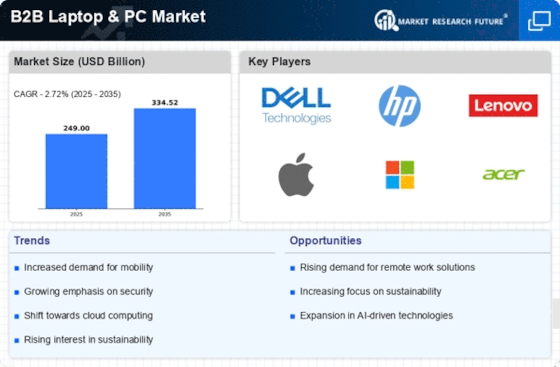

The B2B Laptop & PC Market experiences a notable rise in demand for remote work solutions. As businesses increasingly adopt flexible work arrangements, the need for reliable laptops and PCs that support remote operations becomes paramount. This shift is evidenced by a reported increase in sales of portable devices, with a significant percentage of companies investing in technology that facilitates remote collaboration. The B2B Laptop & PC Market is thus witnessing a transformation, where devices are not only tools for work but also essential components of a cohesive remote work strategy. Companies are prioritizing devices that offer robust performance, security features, and compatibility with various software applications, indicating a shift in purchasing criteria that aligns with the evolving work environment.

Growing Emphasis on Cybersecurity

In the B2B Laptop & PC Market, the growing emphasis on cybersecurity is a critical driver. As cyber threats become more sophisticated, businesses are increasingly aware of the vulnerabilities associated with their IT infrastructure. This awareness leads to heightened investments in laptops and PCs equipped with advanced security features, such as biometric authentication and encryption technologies. Recent data suggests that a substantial portion of IT budgets is now allocated to cybersecurity measures, reflecting the industry's commitment to safeguarding sensitive information. Consequently, manufacturers are responding by integrating enhanced security protocols into their devices, thereby influencing purchasing decisions within the B2B Laptop & PC Market.

Integration of Artificial Intelligence

The integration of artificial intelligence (AI) is becoming a transformative force in the B2B Laptop & PC Market. Businesses are increasingly leveraging AI technologies to enhance productivity and streamline operations. This trend is reflected in the growing demand for laptops and PCs that incorporate AI-driven features, such as predictive analytics and automated workflows. Data indicates that organizations utilizing AI tools report higher efficiency levels, which in turn drives the need for compatible hardware. As AI continues to evolve, its integration into the B2B Laptop & PC Market is likely to reshape product offerings and influence purchasing decisions, as companies seek devices that can support advanced technological capabilities.

Demand for Customization and Scalability

The B2B Laptop & PC Market is characterized by a growing demand for customization and scalability. Businesses are seeking devices that can be tailored to their specific operational needs, which often vary significantly across different sectors. This trend is particularly evident in industries such as healthcare and finance, where specialized software and hardware configurations are essential. As a result, manufacturers are increasingly offering customizable options, allowing companies to select features that align with their unique requirements. Furthermore, the ability to scale technology solutions as businesses grow is becoming a priority, indicating that flexibility in device specifications is a key consideration in the B2B Laptop & PC Market.

Sustainability Initiatives in Technology

Sustainability initiatives are emerging as a pivotal driver in the B2B Laptop & PC Market. Companies are increasingly prioritizing environmentally friendly practices, leading to a demand for laptops and PCs that are designed with sustainability in mind. This includes the use of recyclable materials, energy-efficient components, and responsible manufacturing processes. Recent surveys indicate that a significant number of businesses are willing to invest in sustainable technology, viewing it as a long-term strategy that aligns with corporate social responsibility goals. As a result, manufacturers are adapting their product lines to meet these expectations, thereby influencing purchasing trends within the B2B Laptop & PC Market.