Azo Pigments Size

Azo Pigments Market Growth Projections and Opportunities

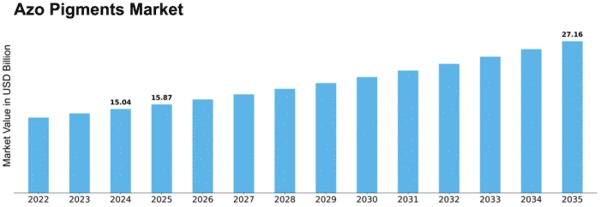

According to MRFR's analysis, the World Azo Pigments Market is forecast to hit the upper figure US$ 2.2 billion with moderate CAGR of ~ 4.15 % between 2023 - 2030.

The Azo Pigments industry is driven by a number of among others that is pivotal in molding its dynamics. Another crucial factor is the application requests stemmed from finish industries, i.e., textiles, paints and coatings, and plastics. These factories also rely on Azo Dyes for achieving a wide range of types of decor for their given products. Such fluctuations in the scale of the demand for Azo Pigments are due to industry trends, and players must therefore exercise caution in paying close attention to these movements in the market.

As well as this, regulatory bodies have a great task in the disability of Azo Pigments market. Introducing strict regulations and guidelines regarding the use of chemicals, where particular issues related to toxicity and their impact on the environment set the terms for market dynamics is a substantial factor in the dynamics of the market. Conformity with these Regulations helps manufacturers not to lose a market access and sustainability.

Technological inventions are also one of the most determining factors in this evolution. Regular into pigmental recipes cooking and upcoming of innovations gives the advantage of the better performance, durability, and plasticity of Azo Pigments. Market actors are required to be active and track these technologies so as not to be left behind and meet user's trending needs.

Another market factor that global market can not forgive, is the global economy. Economic conditions, either locally or abroad, provides a common framework for consumers and companies to make their purchasing decisions. An economic crisis may result in the reduction of the need of non-essential see-through items which include the industries of textiles and automotive which use Azo Pigments heavily.

The competitive situation on the sector in the of the Azo Pigments market is a determining factor. All these have a pronounced effect in bringing a wide variety of manufacturers and suppliers into the market who are not long in utilizing the unique products combinations and specific market segments. Agility and rapidness to adapt to the market's dynamic will be the main force driving market players movement as they would be either aiming at grabbing leading market positions or at stay where they are.

The prices and availability of the commodities (raw materials) also weigh in the market forces making it more challenging for Azo Pigments to contend. Pigment Azo is the aggregation of various chemical compounds, thus the cost of unreliable raw materials affects production costs. The unpredictable nature of supply, as well as fluctuations of material prices is a significant challenge for players it the market, flooring them to develop high-level supply chain management and work their sourcing strategy.

Leave a Comment