Growing Demand in Telecommunications

The Avalanche Photodiodes Market is witnessing a notable increase in demand from the telecommunications sector. With the expansion of fiber optic networks and the need for high-speed data transmission, avalanche photodiodes are becoming essential components in optical communication systems. The market for these devices is anticipated to grow significantly, with estimates suggesting a value of over 1 billion USD by 2026. This growth is largely attributed to the rising need for efficient signal processing and the ability of avalanche photodiodes to operate at high speeds with low noise levels. As telecommunications companies strive to enhance their infrastructure, the reliance on advanced photonic devices like avalanche photodiodes is likely to intensify.

Integration with Emerging Technologies

The Avalanche Photodiodes Market is increasingly integrating with emerging technologies such as artificial intelligence and machine learning. This integration is facilitating the development of advanced sensing and imaging systems that require high-performance photodetection. For example, in autonomous vehicles, avalanche photodiodes are utilized for LIDAR systems, which are critical for navigation and obstacle detection. The market is expected to benefit from this trend, as the demand for smart technologies continues to rise. Analysts predict that the convergence of these technologies will create new opportunities for avalanche photodiodes, potentially leading to a market expansion of around 15% in the coming years.

Rising Applications in Medical Devices

The Avalanche Photodiodes Market is experiencing a rise in applications within the medical device sector. These photodiodes are increasingly used in diagnostic equipment, such as optical coherence tomography and fluorescence imaging systems. The precision and sensitivity of avalanche photodiodes make them ideal for detecting low levels of light, which is crucial in medical diagnostics. The market for medical applications is projected to grow at a rate of 12% annually, driven by the increasing demand for non-invasive diagnostic techniques. As healthcare technology advances, the role of avalanche photodiodes in enhancing medical imaging and diagnostics is likely to expand, further solidifying their importance in the industry.

Technological Advancements in Detection

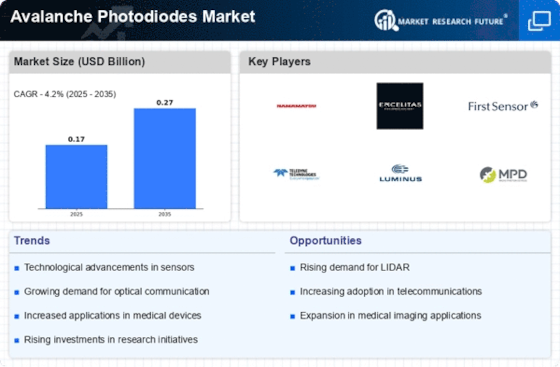

The Avalanche Photodiodes Market is experiencing a surge in technological advancements that enhance detection capabilities. Innovations in semiconductor materials and device architecture are leading to improved sensitivity and response times. For instance, advancements in InGaAs and SiGe materials are enabling photodiodes to operate efficiently in a broader wavelength range, which is crucial for applications in telecommunications and medical imaging. The market is projected to grow at a compound annual growth rate of approximately 10% over the next five years, driven by these technological improvements. As manufacturers continue to invest in research and development, the performance of avalanche photodiodes is expected to reach new heights, thereby expanding their applicability across various sectors.

Increased Investment in Research and Development

The Avalanche Photodiodes Market is benefiting from increased investment in research and development across various sectors. Companies are allocating substantial resources to innovate and improve the performance of avalanche photodiodes, focusing on enhancing their efficiency and reducing costs. This trend is particularly evident in the defense and aerospace sectors, where high-performance photodetectors are critical for applications such as missile guidance and surveillance systems. The market is expected to see a growth rate of approximately 8% as a result of these investments. As R&D efforts continue to yield breakthroughs, the capabilities of avalanche photodiodes are likely to expand, opening new avenues for their application.