Market Analysis

In-depth Analysis of Autonomous Underwater Vehicle Market Industry Landscape

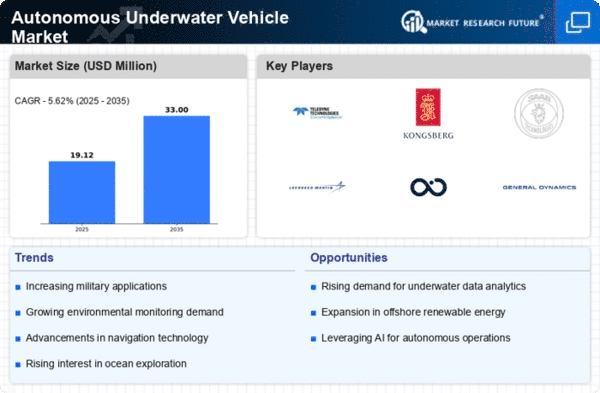

The Autonomous Underwater Vehicle (AUV) market is undergoing dynamic transformations driven by advancements in underwater technology, increased exploration and monitoring activities, and the growing demand for autonomous solutions in marine applications. Autonomous Underwater Vehicles, also known as underwater drones, play a pivotal role in various sectors, including defense, oil and gas, environmental monitoring, and scientific research. Market facets are kept in motion by technological innovation, expanding applications, regulatory compliance, and chase for cheaper and sustainable options.

Innovation in technology is a major driver that determine the way bolster with the emergence of Autonomous Underwater Vehicles market. With the development of highly assessing sensor technoogy, communication systems and navigation abilities, designers of AUV continue to upgrade and improve their systems to offer more complex and efficient underwater solutions. AUVs are at the core of many technological advancements; hence, having autonomy levels, endurance, and a capacity to capture data, which will lead to their adoption and urge companies to employ the best technologies.

Crewless platforms and minor structural changes are increasingly being implemented to meet the emerging applications of AUVs, which contribute significantly to the market dynamics. In the countermeasures, AUVs are employed to locate and remove the mines, thereby detecting any suspicious activity that can be done by intruders from underwater. Oil and gas sector utilizes AUVs for upkeep and supervision of pipelines, seafloor mapping and evaluation of natural environment. Scientific research helps AUVs for oceanographic research, marine biology, and underwater data collection in outer boundaries that people usually cannot safely access. The AUVs' ability to cover multiple fields thus leads to the market dynamics changes as it addresses the varying needs of different industries and, therefore, increases the whole market coverage.

A range of regulatory issues as all the aspects in the same vein will those introduce themselves to be directing the market performance of Autonomous Underwater Vehicles. Owing to the components of the aquatic ecosystem being delicate as well as the possibility of AUV missions affecting the marine environment etc, the respective regulatory bodies are in place to retrack the responsible and sustainable operations of the AUV's. The market dynamics change because of the need to follow the international regulations, get the necessary permits, and develop the protected environment and secure idcas for application, which will help making environmentally conscious and compliant solutions.

Vast amounts of data from both the remote and the deep sea regions of the world are key drivers of AUV s growth, due to their low cost, high efficiency and versatility. While partial automation is not always a risk to the job deflation, a huge amount of these jobs will eventually be off in the cities soon. Although AUVs are not for every purpose due to their costs, autonomy, scalar data collecting capabilities and operators guidance, some applications require AUVs as they have the most capabilities to meet these demands.

Working together in tandem of the maritime sector, AUV market volatility brought by the AUVs in the industry. Manufacturers take partnership and collaboration with research institutions, government, global players, and industry in improving AUV performance and share expertise conceptualize those integrated solutions. These collaboration efforts are the driving force of innovation, interface compatibility and industry standards through which a wide range of alternative AUVs systems are merged that influence the market dynamics with a comprehensive and effective solutions.

Due to the water demand for data gathering as well as real-time monitoring the dynamics of the market of AUVs in this sector is changing.With a growing focus on understanding and mitigating the impacts of climate change, environmental monitoring using AUVs has gained prominence. The market dynamics are influenced by the demand for AUVs equipped with advanced sensors for mapping ocean currents, measuring water quality, and studying marine biodiversity, contributing to scientific research and environmental conservation efforts.

Leave a Comment