Top Industry Leaders in the Autonomous Trucks Market

*Disclaimer: List of key companies in no particular order

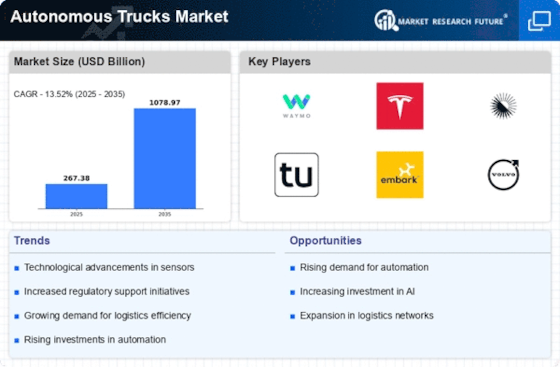

The burgeoning autonomous truck sector is presently a highly contested frontier within the transportation domain. It's a field attracting attention and competition from established industry players, tech giants, and startups, all eager to stake their claims in this fledgling yet potentially transformative market. To thoroughly understand this intricate landscape, an analysis of key player strategies, determinants of market share, and emerging trends that define the competitive landscape is imperative.

Seasoned Players: Leveraging Heritage and Diversification Truck manufacturers like Daimler, Volvo, and PACCAR boast a critical advantage owing to their established brand recognition, expansive dealer networks, and profound comprehension of the trucking sector. Daimler's Mercedes-Benz Trucks division collaborates actively with NVIDIA and Qualcomm to craft Level 4 autonomous trucks for highway usage. Volvo Trucks, in partnership with Aurora, concentrates on Level 3 automation for North American highway trucking routes. PACCAR's DAF Trucks division, employing a cautious approach, tests autonomous trucks in controlled environments while prioritizing safety adherence.

Tech Titans: Disrupting through Innovation and Scale Companies such as Google and Uber wield their prowess in AI, software development, and data analytics to disrupt the market. Google's Waymo subsidiary stands as a pioneer in autonomous vehicle technology, actively testing autonomous trucks on highways in Arizona and Texas. Uber's Freight division pilots Level 4 autonomous trucks for long-haul routes, collaborating with manufacturers like Volvo and startups like TuSimple. These tech giants possess the data, computational abilities, and skilled workforce requisite to revolutionize the industry.

Startups: Agility and Tailored Solutions Agile startups like TuSimple, Aurora, and Embark Trucks carve their niches by focusing on specific functionalities or regions. TuSimple, a frontrunner in Level 4 highway trucking technology, has secured partnerships with major logistics companies like UPS and FedEx. Aurora, emphasizing LiDAR technology and safety redundancies, garners investments from Volvo and PACCAR. Embark Trucks, specializing in driver-in-the-loop operations for regional routes, offers solutions for short-haul deliveries where infrastructure limitations hinder full autonomy.

Market Share Determinants Assessing market share in this nascent realm surpasses traditional metrics such as sales volume. Crucial factors encompass:

Technology Leadership: Firms boasting advanced autonomous driving systems, robust sensor arrays, and efficient data processing algorithms will hold a competitive edge.

Partnerships and Collaborations: For scaling operations and gaining market access, forming strategic alliances with traditional truck manufacturers, logistics entities, and tech providers is vital.

Regulatory Framework: Adapting to evolving regulations and securing necessary permits for testing and deployment across different regions remains essential.

Infrastructure Readiness: Market penetration hinges on factors like the availability of compatible infrastructure, including designated autonomous truck lanes and V2X communication networks.

Emerging Trends and Landscape Shifts Several significant trends define the autonomous truck market:

-

Tailored Use Cases: Companies shift from generic solutions to specialized applications for long-haul, regional, or urban deliveries to cater to distinct customer needs. -

Integration with Logistics: Integration with broader logistics platforms streamlines route planning, cargo management, and fleet optimization. -

Cybersecurity Focus: Addressing vulnerabilities and ensuring data privacy are paramount to fostering trust and widespread adoption. -

Environmental Impact: Autonomous trucks' potential to reduce emissions and fuel consumption attracts eco-conscious companies and investors.

Competitive Dynamics: A Multifaceted Race The competitive landscape is characterized by intense rivalry across diverse segments. Established players leverage existing infrastructure and brand recognition, tech giants bring technological prowess and data-driven approaches, while startups offer agility and niche solutions. Success hinges on technological prowess, strategic partnerships, regulatory compliance, and adaptability to emerging trends. The race for dominance in this transformative market is ongoing, with no definitive victor yet, making it an enthralling space to watch as it reshapes the future of transportation.

While this analysis provides a snapshot of the current competitive landscape, it's crucial to note that the autonomous truck market is rapidly evolving. Stay tuned for further updates and insights as this transformative market continues to unfold.

Industry Developments and Recent Updates:

- Volvo Trucks announced a partnership with Aurora to develop autonomous trucks for the North American market, with deployment expected in 2025.

- BMW revealed plans to test level 4 autonomous trucks on German roads starting in 2024.

- GM Cruise obtained a permit to operate driverless taxis in San Francisco, intending to launch a commercial robotaxi service in early 2024.

- Ford plans to commence testing level 4 autonomous trucks on U.S. public roads in 2024.

- Delphi announced a partnership with TuSimple to deploy autonomous trucks in China by 2025.

Leading Companies in Autonomous Trucks:

- AB Volvo (Sweden)

- BMW AG (Germany)

- General Motor Company (U.S.)

- Volkswagen AG (Germany)

- Ford Motor Co. (U.S.)

- Delphi Automotive PLC (Ireland)

- Embark Trucks (U.S.)

- Robert Bosch GmbH (Germany)

- Uber Technologies Inc. (U.S.)

- Tesla Inc. (U.S.)

- Google Inc (U.S.), among others.