Consumer Demand for Safety

Safety remains a paramount concern for consumers in the Autonomous Luxury Vehicle Market. As vehicles become increasingly autonomous, the expectation for enhanced safety features grows. Data indicates that approximately 70% of consumers prioritize safety when considering luxury vehicles, driving manufacturers to incorporate advanced safety technologies. Features such as collision avoidance systems, automatic emergency braking, and real-time monitoring systems are becoming standard in luxury models. This heightened focus on safety not only addresses consumer concerns but also enhances brand reputation, as companies that prioritize safety are likely to gain a competitive edge. Consequently, the Autonomous Luxury Vehicle Market is evolving to meet these demands, ensuring that safety is at the forefront of design and engineering.

Sustainability Initiatives

The Autonomous Luxury Vehicle Market is increasingly influenced by sustainability initiatives as consumers become more environmentally conscious. The shift towards electric and hybrid vehicles is notable, with a significant portion of luxury consumers expressing a preference for eco-friendly options. Reports suggest that the market for electric luxury vehicles is expected to grow by 25% over the next five years. Manufacturers are responding by investing in sustainable materials and production processes, aiming to reduce their carbon footprint. This trend not only aligns with consumer values but also positions brands as leaders in sustainability, potentially attracting a broader customer base. As the Autonomous Luxury Vehicle Market embraces these initiatives, it is likely to see a transformation in consumer perceptions and purchasing behaviors.

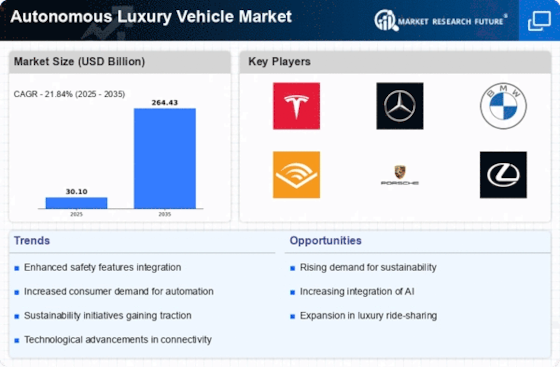

Technological Advancements

The Autonomous Luxury Vehicle Market is experiencing rapid technological advancements that are reshaping the landscape of luxury transportation. Innovations in artificial intelligence, machine learning, and sensor technologies are enhancing vehicle capabilities, allowing for improved safety and efficiency. For instance, the integration of advanced driver-assistance systems (ADAS) is becoming commonplace, with a projected market growth rate of 20% annually. These technologies not only elevate the driving experience but also align with consumer expectations for high-end features. As manufacturers invest heavily in research and development, the Autonomous Luxury Vehicle Market is likely to witness a surge in new models equipped with cutting-edge technology, appealing to tech-savvy consumers who prioritize innovation in their luxury purchases.

Personalization and Customization

Personalization is becoming a key driver in the Autonomous Luxury Vehicle Market, as consumers seek unique experiences tailored to their preferences. Luxury vehicle buyers are increasingly interested in customization options, from interior finishes to advanced technology features. Data indicates that nearly 60% of luxury consumers are willing to pay a premium for personalized options, reflecting a shift towards bespoke offerings. This trend is prompting manufacturers to develop platforms that allow for extensive customization, enhancing the overall ownership experience. As the Autonomous Luxury Vehicle Market evolves, the ability to offer personalized solutions may become a critical differentiator, enabling brands to foster deeper connections with their clientele.

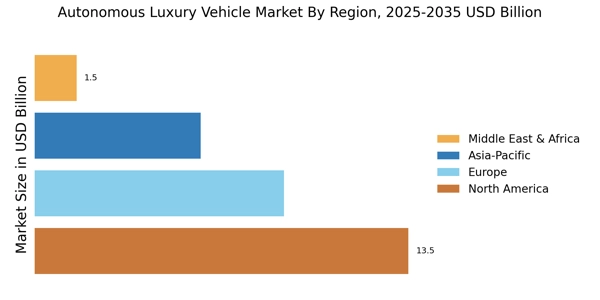

Regulatory Support and Infrastructure Development

Regulatory support and infrastructure development are crucial factors influencing the Autonomous Luxury Vehicle Market. Governments are increasingly recognizing the potential benefits of autonomous vehicles, leading to the establishment of favorable regulations and investment in necessary infrastructure. Initiatives such as dedicated lanes for autonomous vehicles and improved traffic management systems are being implemented in various regions. This supportive environment is expected to facilitate the adoption of autonomous luxury vehicles, as consumers feel more confident in their safety and reliability. Furthermore, as infrastructure continues to evolve, the Autonomous Luxury Vehicle Market is likely to experience accelerated growth, driven by enhanced accessibility and convenience for consumers.